Mastering your finances starts with a well-organized Weekly Personal Budget Planner, designed to help track income, expenses, and savings goals effectively. Monitoring weekly spending patterns enables better control over financial decisions and boosts the ability to plan for both short-term needs and long-term objectives. Explore the Excel template below to simplify your budgeting process and take charge of your financial future today.

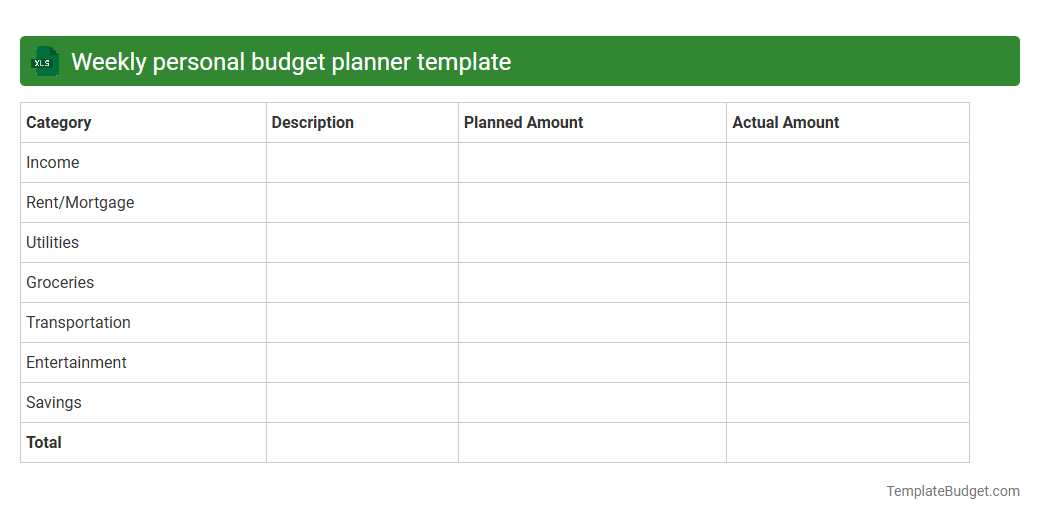

Weekly personal budget planner template

An Excel Weekly Personal Budget Planner Template typically includes categories for income sources, fixed expenses, variable expenses, and savings goals, allowing users to track cash flow on a weekly basis. It features columns for date, description, category, planned amount, actual amount spent, and variance, facilitating detailed monitoring and adjustment of spending habits. Charts or graphs often accompany the data, providing visual summaries of budget performance and helping users maintain financial discipline.

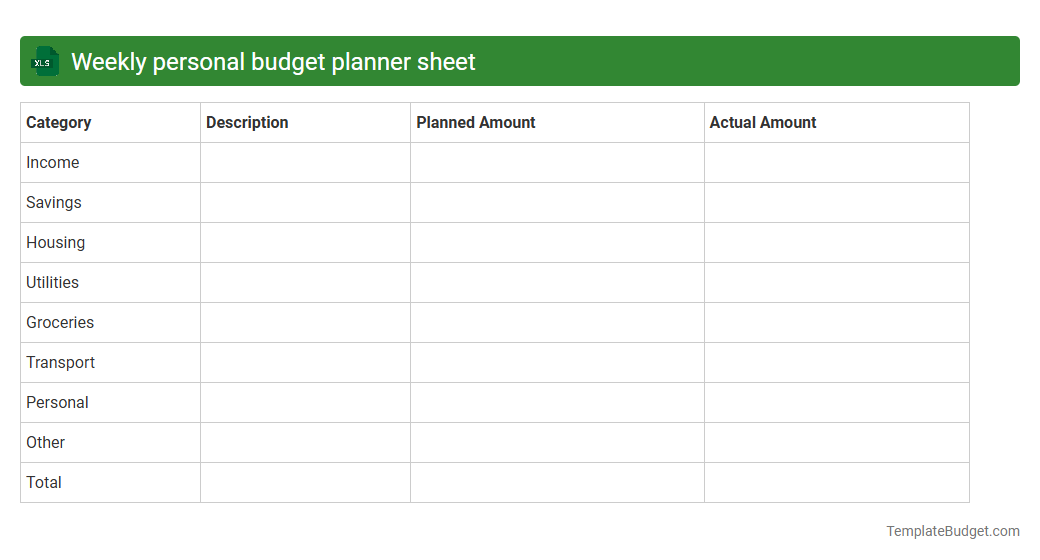

Weekly personal budget planner sheet

A Weekly Personal Budget Planner Excel sheet typically includes categorized expense sections such as groceries, transportation, entertainment, and utilities, alongside income tracking fields. It features columns for date, description, planned amount, actual amount, and balance calculations to monitor spending accuracy. Formulas for automatic summation and variance analysis help users maintain financial control and identify budget deviations.

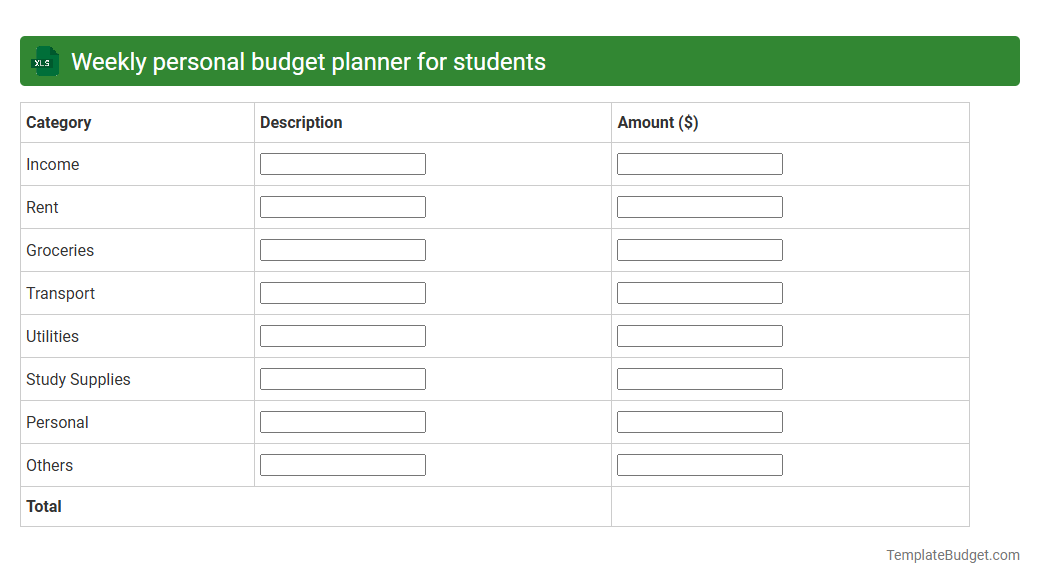

Weekly personal budget planner for students

An Excel document for a weekly personal budget planner for students typically contains categorized expense fields such as groceries, transportation, entertainment, and utilities, alongside sections for income sources like part-time jobs or allowances. It includes formulas for automatic calculations of total income, total expenses, and net savings, helping users track their financial status throughout the week. Charts or graphs may be embedded to visually represent spending patterns and assist in making informed budgeting decisions.

Weekly personal budget tracker

An Excel document titled Weekly Personal Budget Tracker typically contains categorized expense and income tables, including sections for groceries, utilities, entertainment, and salary. It often features formulas for automatic calculations of weekly totals, savings, and budget variance. Charts or graphs summarizing spending patterns and cash flow trends may also be included for quick visual analysis.

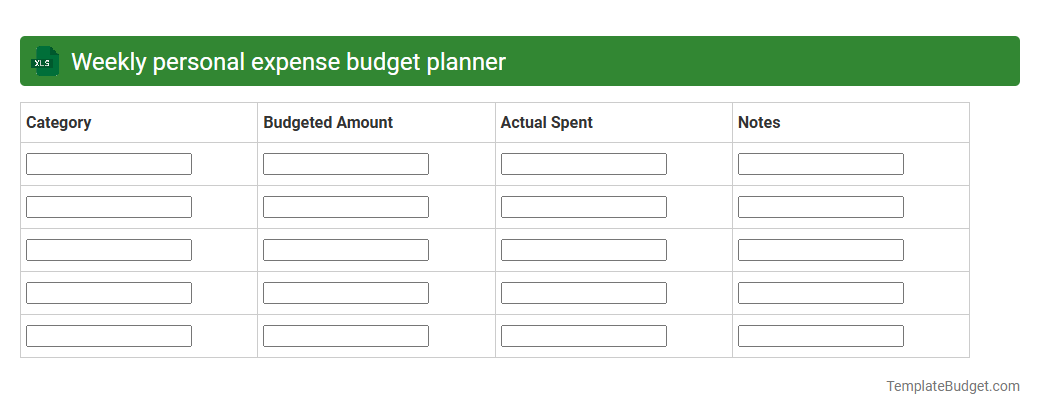

Weekly personal expense budget planner

A Weekly Personal Expense Budget Planner in Excel typically contains categorized expense fields such as groceries, transportation, utilities, and entertainment, alongside date and amount columns to track weekly spending. It often includes formulas to calculate total expenses, remaining budget, and percentage of budget used for each category. Visual elements like charts or graphs may be incorporated to provide a clear overview of financial habits and budget adherence.

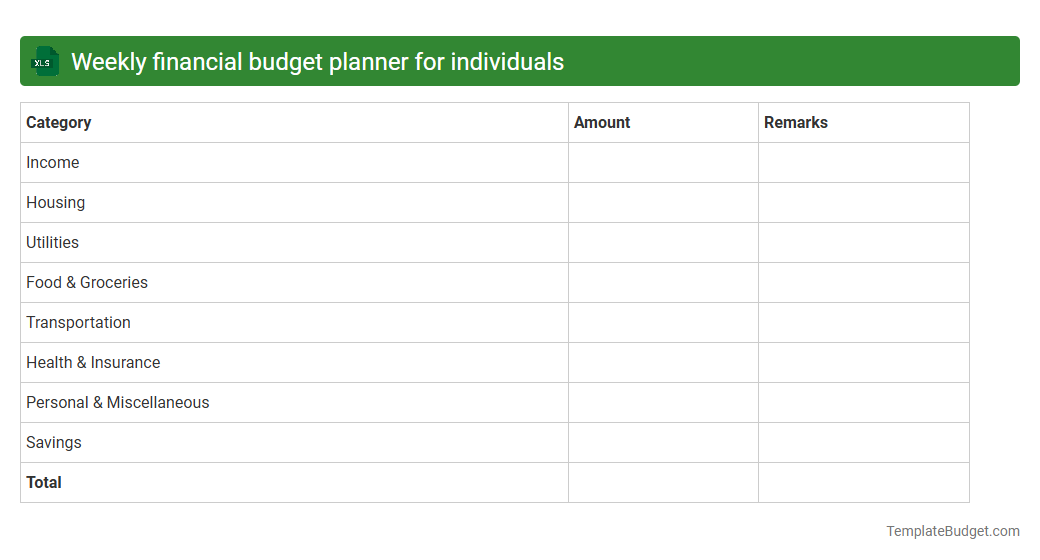

Weekly financial budget planner for individuals

An Excel document for a weekly financial budget planner typically contains categorized expense tracking sections such as income, fixed expenses, variable expenses, and savings goals. It includes formulas to calculate totals, variances, and remaining balances, enabling users to monitor cash flow effectively. Graphs or charts often visualize spending patterns to support better financial decision-making.

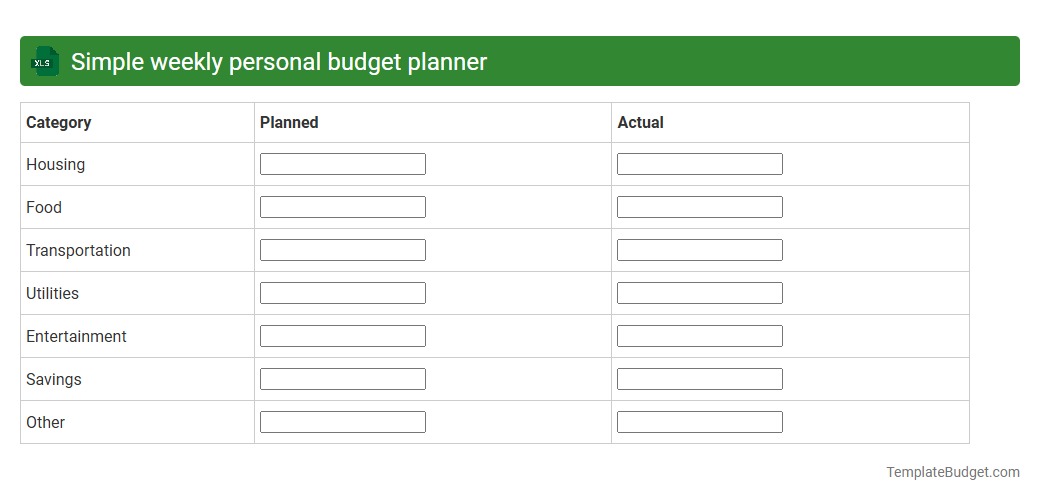

Simple weekly personal budget planner

An Excel document for a simple weekly personal budget planner typically includes categorized expense fields such as groceries, transportation, entertainment, and utilities. It often features columns for planned budget amounts, actual expenses, and variance calculations to track spending accuracy. Summary sections might display total income, total expenses, and net balance to provide a clear financial overview for the week.

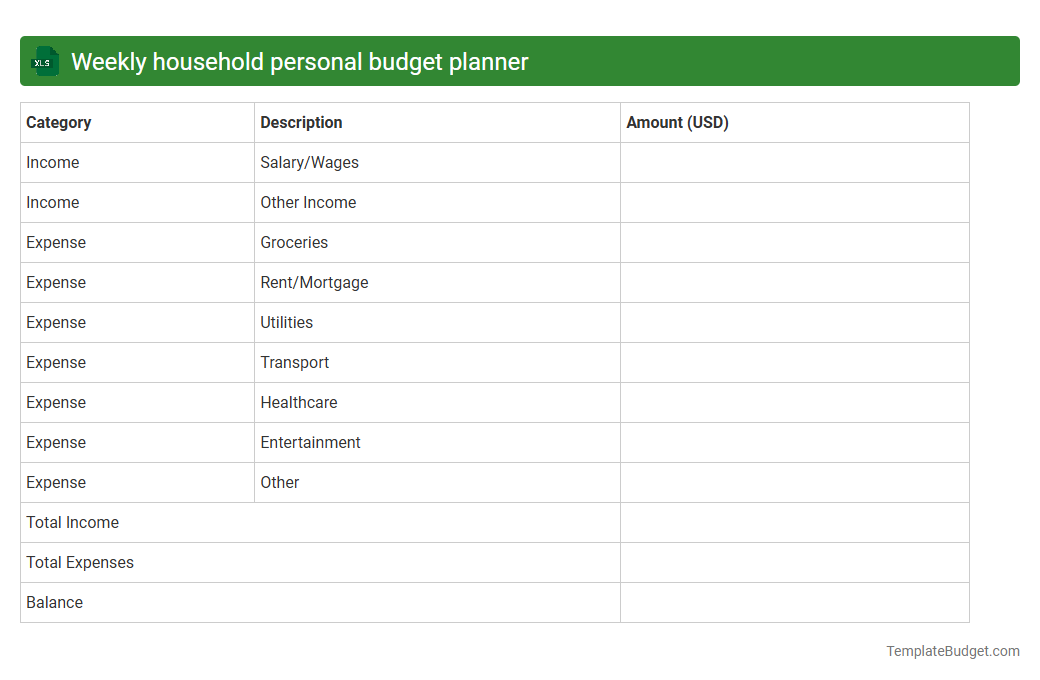

Weekly household personal budget planner

An Excel Weekly Household Personal Budget Planner typically contains categorized expense sections such as groceries, utilities, transportation, and entertainment, alongside income sources like salary or freelance earnings. It features columns for tracking planned versus actual spending, allowing users to monitor budget adherence and identify areas for adjustment. Formulas automatically calculate totals, balances, and variances, providing a clear overview of financial health throughout the week.

Digital weekly personal budget planner

An Excel document for a digital weekly personal budget planner typically contains categorized expense and income tables, including sections for bills, groceries, entertainment, and savings. It incorporates formulas to automatically calculate totals, track spending against budget limits, and visualize financial trends with charts or graphs. Essential features often include date tags, weekly summaries, and customizable input fields for user-specific financial goals and adjustments.

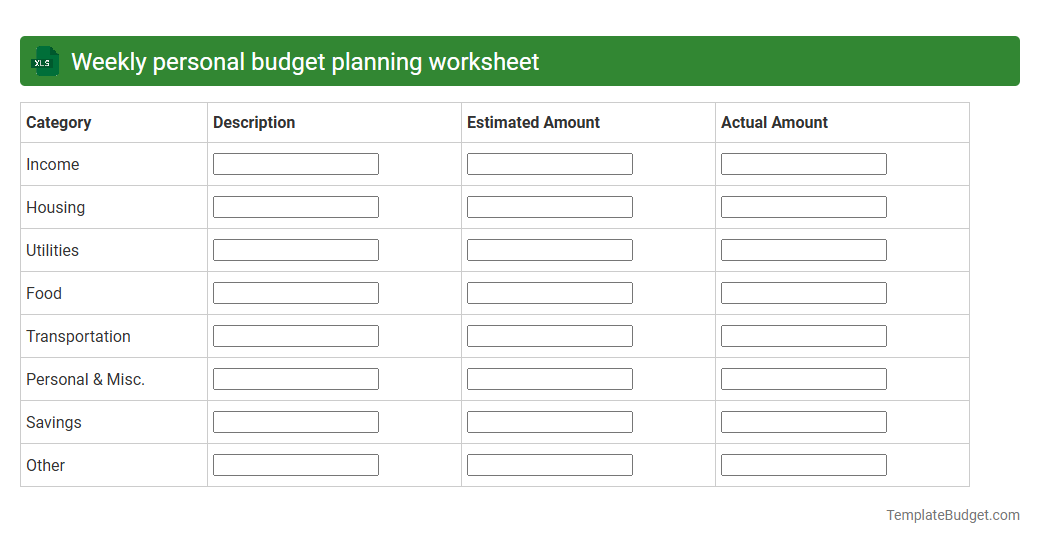

Weekly personal budget planning worksheet

A weekly personal budget planning worksheet in an Excel document typically contains categorized expense columns such as housing, groceries, transportation, entertainment, and savings. Rows are organized by dates or weeks, with input fields for estimated and actual spending, enabling real-time tracking and comparison. Built-in formulas calculate totals, variances, and remaining budget, providing a clear overview for effective financial management.

Understanding the Importance of Weekly Personal Budget Planning

Weekly personal budget planning helps you maintain control over your finances by providing a clear overview of your income and expenses. It allows timely adjustments, preventing overspending and helping you save effectively. Prioritizing weekly budgeting ensures consistent financial health and progress.

Setting Realistic Financial Goals

Setting realistic financial goals gives your budget purpose and direction, helping you stay motivated and focused. Balance short-term needs with long-term aspirations to create achievable targets. Clear, measurable financial goals enhance your budgeting success.

Identifying and Tracking Your Income Sources

Accurately listing all income sources ensures your budget reflects your true financial situation. Regular tracking helps detect fluctuating income and plan accordingly. Keep a detailed record of each income source for precise budgeting.

Categorizing Weekly Expenses Effectively

Organizing expenses into categories like essentials, discretionary, and savings clarifies spending habits. Effective categorization makes it easier to identify areas to cut back or reallocate funds. Use clear expense categories to optimize your budget.

Creating a Simple Weekly Budget Template

A simple template focuses on income, expenses, and savings to facilitate quick updates and clear insights. Customizable templates cater to individual lifestyles and financial goals, improving usability. A well-designed budget template is key to consistent budgeting.

Managing Unexpected Costs in Your Budget

Including a buffer for unexpected expenses prevents disruptions and financial stress. Planning for emergencies ensures your overall budget remains balanced during surprises. Allocate funds specifically for unexpected costs to maintain stability.

Strategies for Sticking to Your Weekly Budget

Regular monitoring, setting spending limits, and rewarding progress encourage adherence to your budget. Accountability partners or apps can help maintain discipline and motivation. Consistent use of budgeting strategies leads to financial control.

Utilizing Budget Planner Apps and Tools

Budget planner apps automate tracking, provide reminders, and offer insightful reports for better decision-making. These tools simplify input and increase accuracy, saving time and reducing errors. Integrating budgeting apps enhances your financial management.

Reviewing and Adjusting Your Budget Weekly

Weekly reviews help track progress, spot trends, and address challenges promptly. Adjusting your budget based on real data keeps it relevant and effective. Consistent budget reviews ensure ongoing financial improvement.

Tips for Building Long-term Financial Habits

Develop steady saving, controlled spending, and regular budget assessment as core habits. Long-term discipline fosters financial security and growth, reducing stress over money matters. Cultivate financial habits that support lasting wealth management.

More Weekly Excel Templates