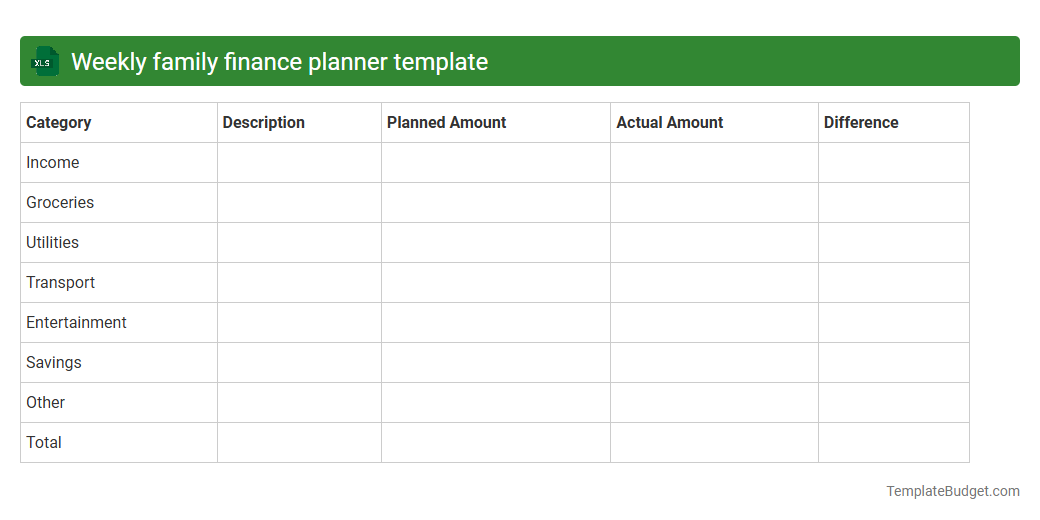

Weekly family finance planner template

An Excel Weekly Family Finance Planner template typically includes categorized sections for income, expenses, savings, and budget goals, with columns for dates, descriptions, amounts, and payment methods. It often features built-in formulas for automatic calculations of totals, balances, and variance analysis to track spending patterns and financial progress. Charts and graphs are commonly embedded to provide visual summaries of weekly financial health, helping families manage their budget effectively.

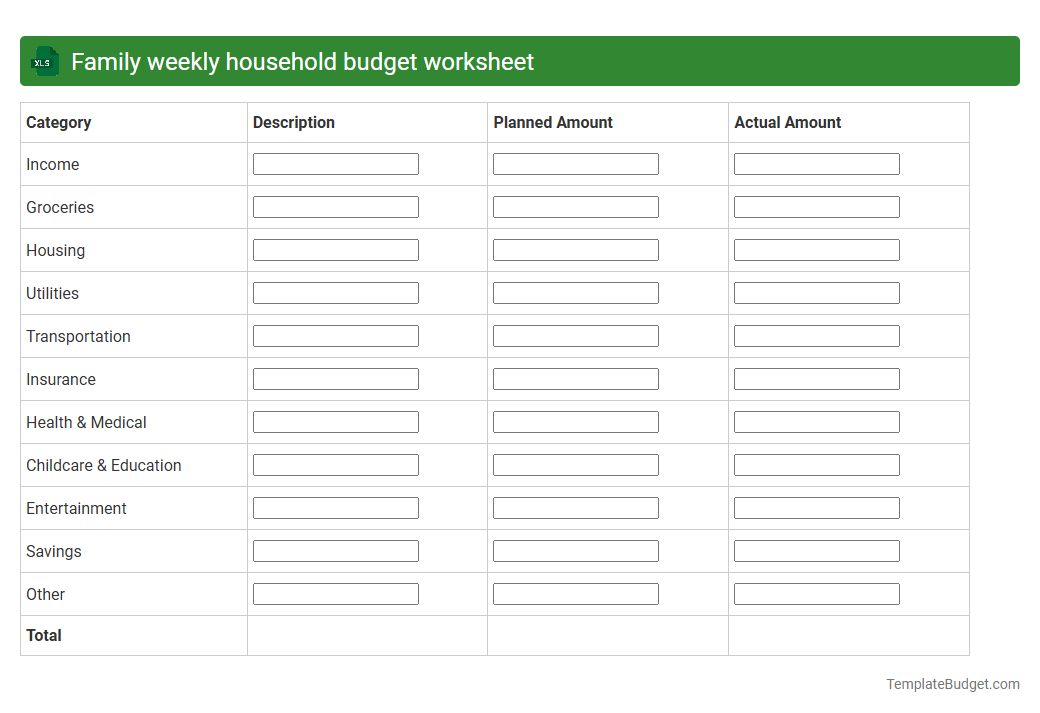

Family weekly household budget worksheet

An Excel document containing a Family Weekly Household Budget Worksheet typically includes categorized expense fields such as groceries, utilities, transportation, and entertainment, organized by day or week. It features columns for budgeted amounts, actual spending, and variance analysis to track financial performance accurately. Formulas automate subtotal and total calculations, providing clear insights into cash flow management and helping identify potential savings opportunities.

Weekly family expense tracker sheet

A weekly family expense tracker sheet in Excel typically includes columns for date, expense category, description, amount spent, and payment method, providing a detailed record of household transactions. It often features summary sections with weekly totals, category-wise expenditure analysis, and budget comparison charts to monitor spending patterns. Formulas and conditional formatting enhance data accuracy and highlight overspending, facilitating effective financial management for families.

Family budget spreadsheet for weekly use

A family budget spreadsheet for weekly use typically contains categorized income sources, fixed and variable expenses, and weekly spending summaries. It includes columns for dates, descriptions, budgeted amounts, actual expenses, and variance calculations to help track financial goals. Charts and graphs may be embedded to visualize spending patterns and monitor budget adherence over time.

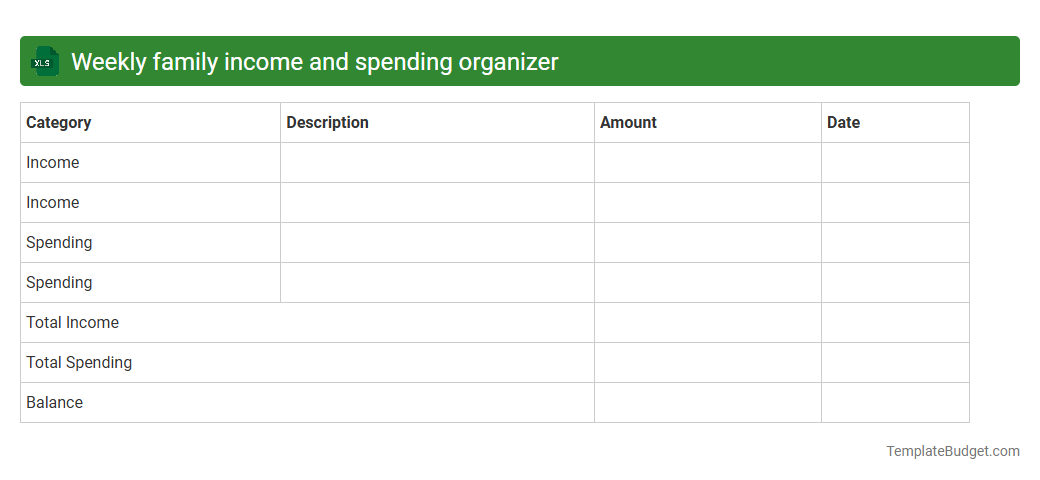

Weekly family income and spending organizer

An Excel document titled "Weekly Family Income and Spending Organizer" typically contains detailed tables tracking sources of income, such as salaries, bonuses, and other earnings, alongside categorized expenses like groceries, utilities, transportation, and entertainment. It often includes formulas for calculating net income, weekly savings, and budget variances, providing a clear overview of financial health. Visual elements like charts or graphs summarize spending patterns to help identify trends and optimize future budgeting.

Family weekly savings tracker template

An Excel Family Weekly Savings Tracker template typically includes columns for dates, income sources, weekly expenses, and savings goals. It features rows for categorizing spending such as groceries, utilities, entertainment, and miscellaneous costs, enabling detailed financial monitoring. Formulas automatically calculate total expenses, savings for each week, and progress toward monthly or annual savings targets.

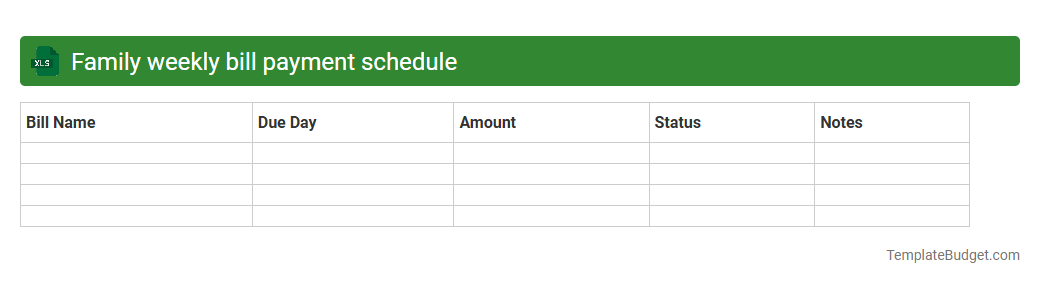

Family weekly bill payment schedule

An Excel document titled "Family Weekly Bill Payment Schedule" typically contains organized columns for bill categories, due dates, payment amounts, and payment status. It often includes a weekly calendar view, formulas to calculate total expenses, and conditional formatting to highlight upcoming or overdue payments. This schedule helps families track and manage finances efficiently, ensuring timely payments and budget control.

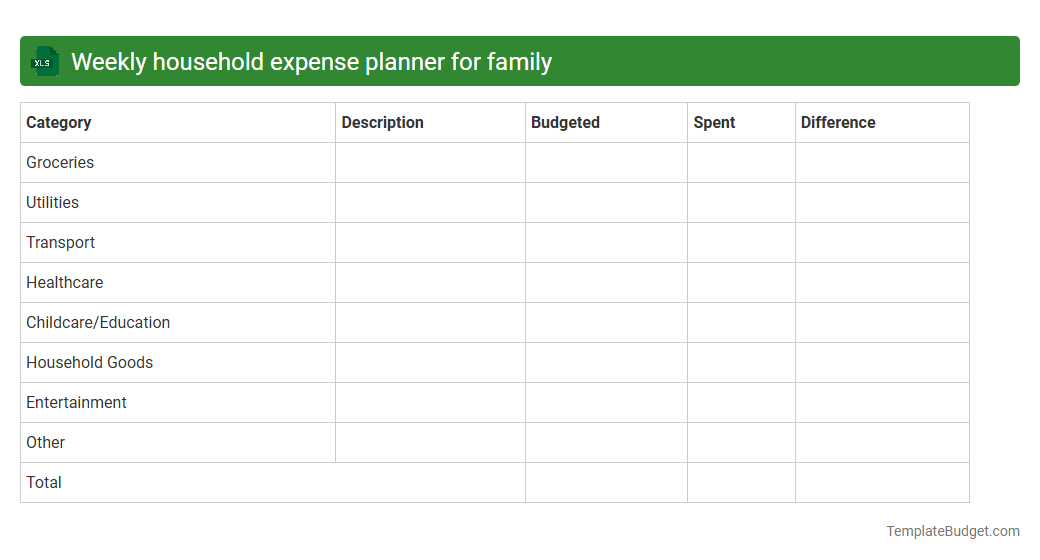

Weekly household expense planner for family

A weekly household expense planner for family typically contains categorized expense columns such as groceries, utilities, transportation, and entertainment, along with income sources and total budget allocations. It includes date-wise tracking rows, formulas for automatic summation, and comparison fields to monitor overspending or savings. Charts or graphs may be embedded to visualize spending patterns and financial health over the weeks.

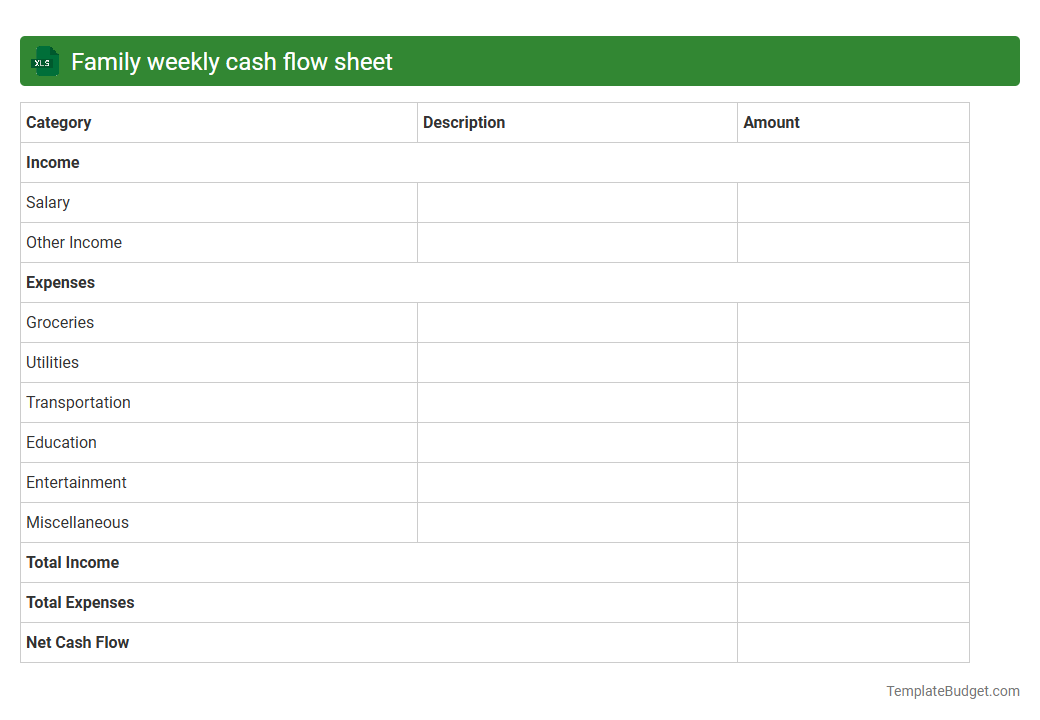

Family weekly cash flow sheet

An Excel document titled "Family Weekly Cash Flow Sheet" typically contains detailed entries of weekly income sources such as salaries and allowances, along with categorized expenses including groceries, utilities, transportation, and entertainment. The sheet often features columns for planned versus actual amounts, enabling effective tracking and comparison of cash inflows and outflows. Summary sections may include weekly totals, net savings, and graphical representations like bar charts or pie charts to visualize spending patterns and financial health.

Weekly family budget management sheet

A weekly family budget management Excel document typically contains categorized expense and income sections, including groceries, utilities, transportation, entertainment, and savings. It features formulas to calculate total weekly spending, remaining balance, and budget variance for precise financial tracking. Charts or graphs may be included to visualize spending patterns and help optimize family budgeting decisions.

Introduction to Weekly Family Budgeting

A weekly family budget is a practical approach to managing household finances by tracking income and expenses every seven days. It helps families stay on top of their financial responsibilities and make informed spending decisions. Regular budgeting increases awareness and fosters a habit of financial discipline.

Benefits of Using a Weekly Budget Template

Using a weekly budget template simplifies the budgeting process, enabling families to organize expenses with ease. It promotes better spending habits and helps prevent overspending by providing a clear financial overview. Additionally, weekly tracking allows for quick adjustments to stay on target.

Essential Components of a Weekly Family Budget

A comprehensive weekly budget must include income sources, fixed and variable expenses, savings, and debt payments. Categorizing expenses properly ensures all financial obligations are accounted for. Clear documentation supports accurate monitoring and financial planning.

How to Set Financial Goals for Your Family

Setting financial goals involves identifying short-term and long-term objectives that benefit the whole family. Goals should be specific, measurable, and realistic, such as saving for emergencies or planning a vacation. These targets guide the budgeting process and motivate disciplined spending.

Step-by-Step Guide to Creating a Weekly Family Budget Template

Start by listing all income streams and estimating weekly expenses. Allocate funds to essential categories, prioritize savings, and adjust for variable costs. Regularly review and update the budget template to reflect any changes in financial circumstances.

Key Categories to Include in Your Weekly Budget

Important categories include housing, utilities, groceries, transportation, education, savings, and entertainment. Each category should have a designated budget amount reflecting actual spending habits. Organizing expenses this way improves clarity and control over finances.

Tips for Tracking and Managing Family Expenses

Consistently record all expenditures and compare them against the budget allocations. Use apps or spreadsheets to simplify tracking and maintain accuracy. Involving all family members in the process fosters transparency and collective responsibility for the family budget.

Common Mistakes to Avoid in Weekly Budgeting

Avoid underestimating expenses, neglecting irregular costs, and overlooking savings contributions. Failure to adjust the budget for unexpected changes can lead to overspending. Keeping the budget realistic and flexible ensures better financial outcomes.

Best Free and Paid Weekly Family Budget Templates

Popular options include Excel spreadsheets, Google Sheets templates, and budgeting apps offering free and premium versions. Paid templates often provide advanced features like charts and automated calculations. Selecting the right template depends on your family's needs and technical comfort.

Frequently Asked Questions about Weekly Family Budgets

Common questions address how to start budgeting, handle irregular income, and balance savings with expenses. Answers usually emphasize consistency, adaptability, and communication within the family. Understanding these FAQs can improve budgeting success significantly.