Managing personal finances becomes simpler and more efficient with a detailed monthly budget Excel template designed to track income, expenses, and savings goals. This customizable spreadsheet provides clear categories and built-in formulas that help users maintain financial discipline and make informed decisions. Explore the comprehensive Excel template below to take control of your monthly budgeting with ease.

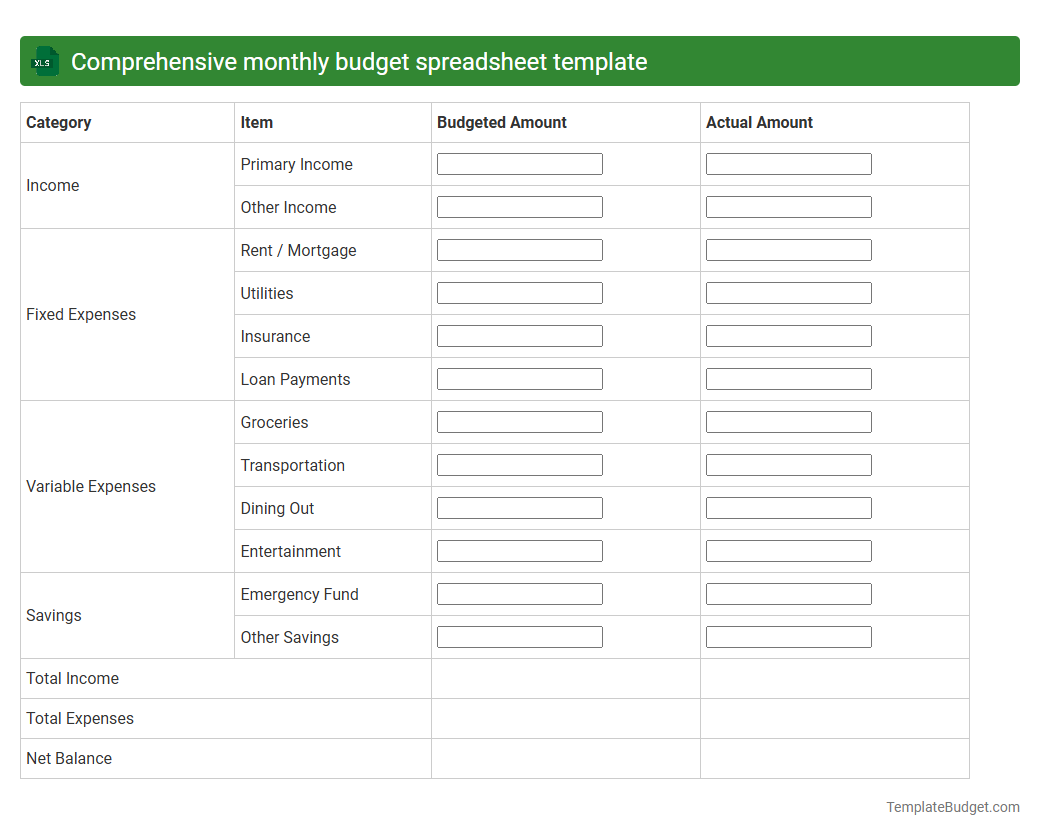

Comprehensive monthly budget spreadsheet template

A comprehensive monthly budget spreadsheet template typically contains categorized expense fields such as housing, utilities, groceries, transportation, and entertainment, along with dedicated sections for income sources like salary, investments, and freelance work. It includes dynamic formulas that calculate total income, total expenses, and net savings, often featuring charts or graphs to visualize spending patterns. Users can track monthly financial goals, monitor budget variances, and adjust allocations for efficient money management.

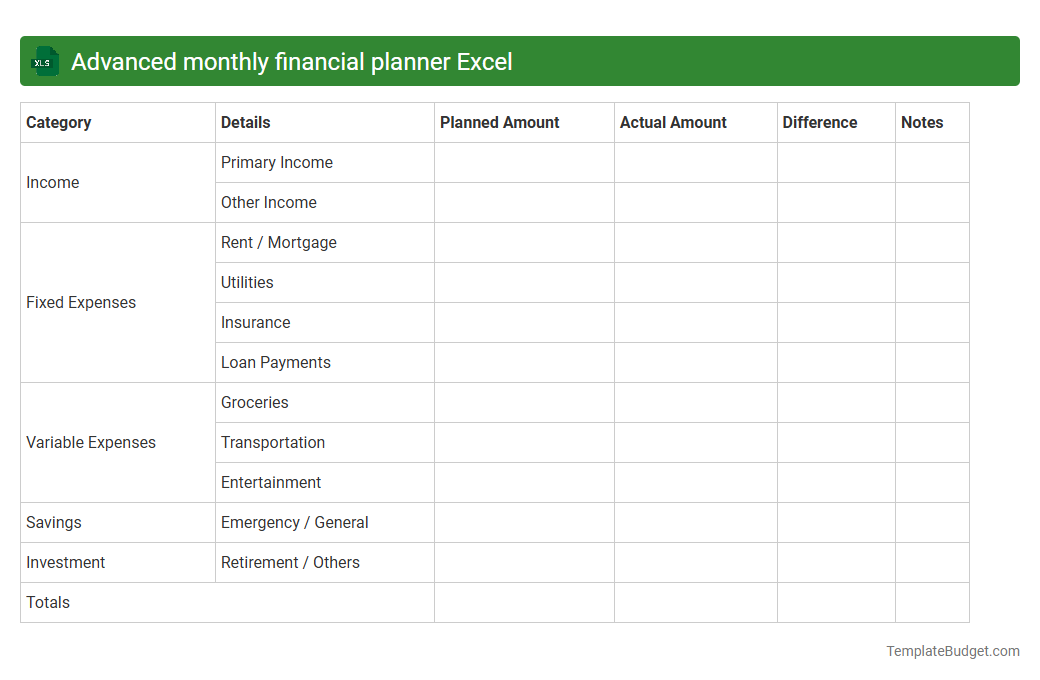

Advanced monthly financial planner Excel

An Advanced Monthly Financial Planner Excel typically contains detailed spreadsheets organized by income, expenses, savings, and investments, allowing users to track cash flow with precision. It includes pivot tables, dynamic charts, and customizable formulas to analyze budget trends and forecast future financial scenarios. Automation features such as conditional formatting and macro-enabled buttons enhance efficiency in managing monthly financial data.

Detailed household budget tracker Excel

A detailed household budget tracker Excel typically contains categorized expense and income sections, such as utilities, groceries, rent or mortgage, transportation, entertainment, and savings. It includes formulas for automatic calculations of monthly totals, budget variances, and cumulative annual summaries to monitor cash flow effectively. Charts and pivot tables may be embedded to visualize spending patterns and track financial goals over time.

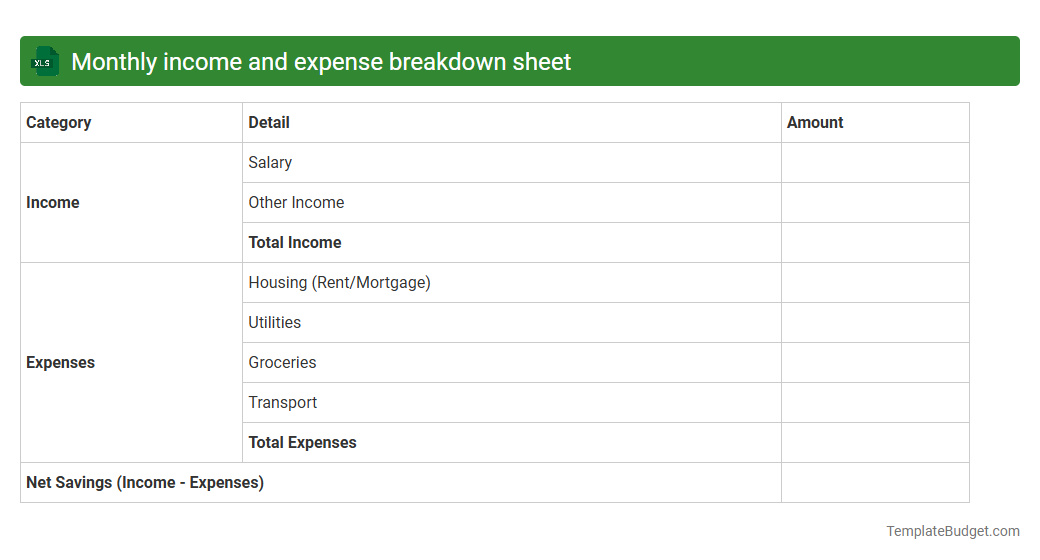

Monthly income and expense breakdown sheet

An Excel document titled "Monthly Income and Expense Breakdown" typically includes categorized lists of income sources such as salaries, bonuses, and rental income, alongside detailed expense categories like groceries, utilities, rent, and entertainment. It features columns for date, description, amount, and payment method to facilitate accurate tracking and reconciliation. Pivot tables, charts, and formulas like SUM and IF functions are often embedded to analyze trends, calculate totals, and forecast future budgets effectively.

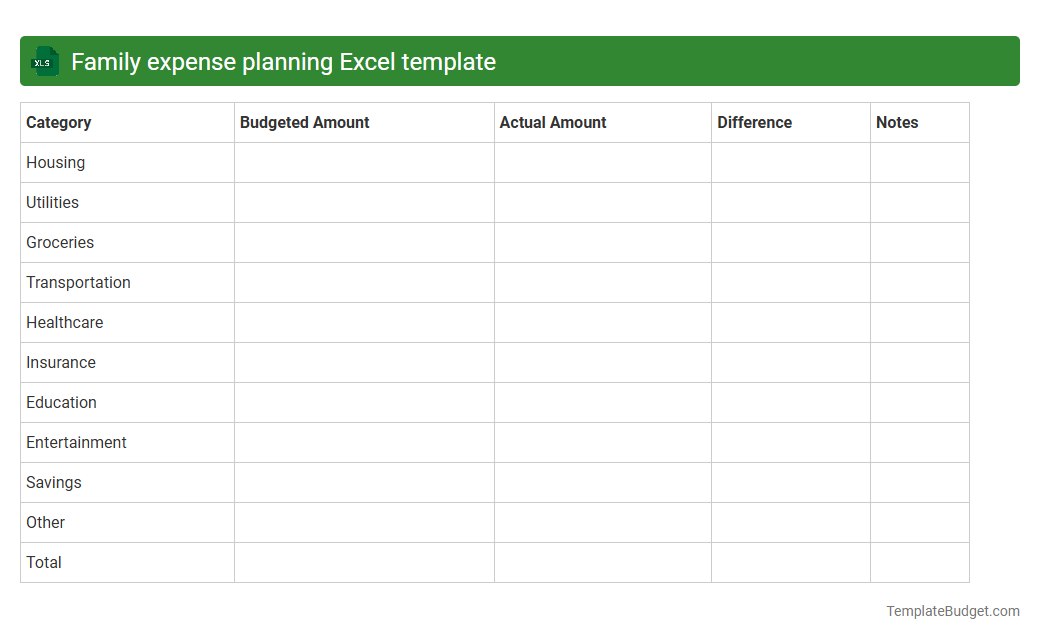

Family expense planning Excel template

A Family Expense Planning Excel template typically contains categorized expense sections such as housing, utilities, groceries, transportation, and entertainment. It includes rows for income sources, fixed and variable costs, and formulas to calculate total expenses, savings, and budget variances. Charts and summary tables often visualize monthly spending patterns to aid in effective financial management.

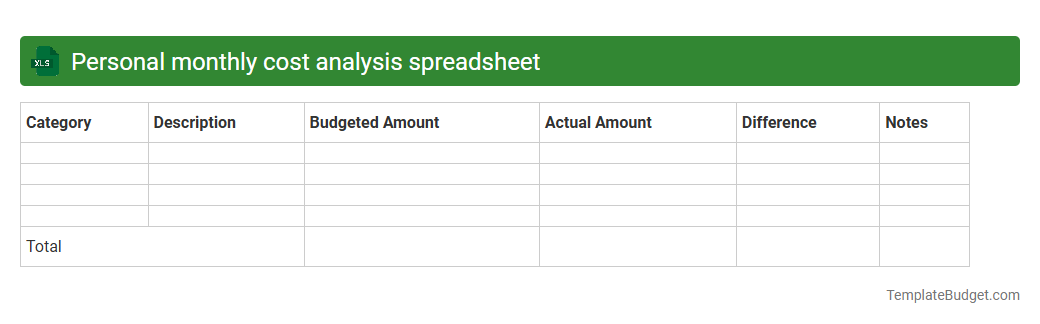

Personal monthly cost analysis spreadsheet

A personal monthly cost analysis spreadsheet typically includes categories such as housing, utilities, groceries, transportation, entertainment, and savings to track expenses accurately. It often features columns for planned budget, actual spending, and variance to manage and optimize financial performance. Visual aids like charts or graphs are commonly incorporated to provide clear insights into spending patterns and budget adherence.

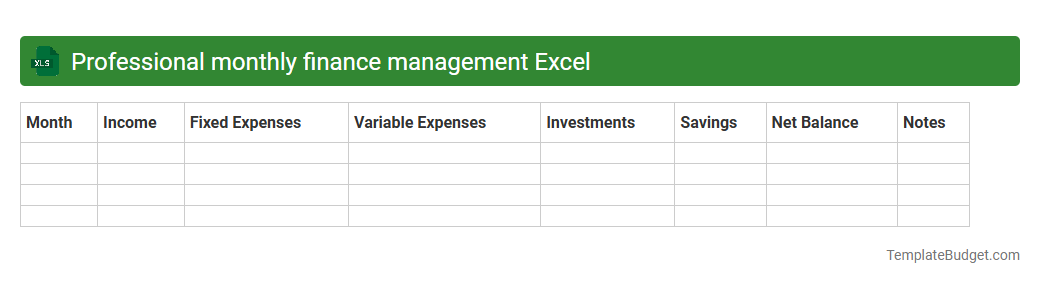

Professional monthly finance management Excel

A professional monthly finance management Excel document typically includes detailed income tracking, expense categorization, and budget comparisons to monitor cash flow effectively. It features dynamic pivot tables, charts for visual financial analysis, and built-in formulas for automatic calculations of totals, variances, and forecast projections. The spreadsheet often integrates sections for bill payments, savings goals, debt tracking, and customizable financial reports to support comprehensive budget planning and decision-making.

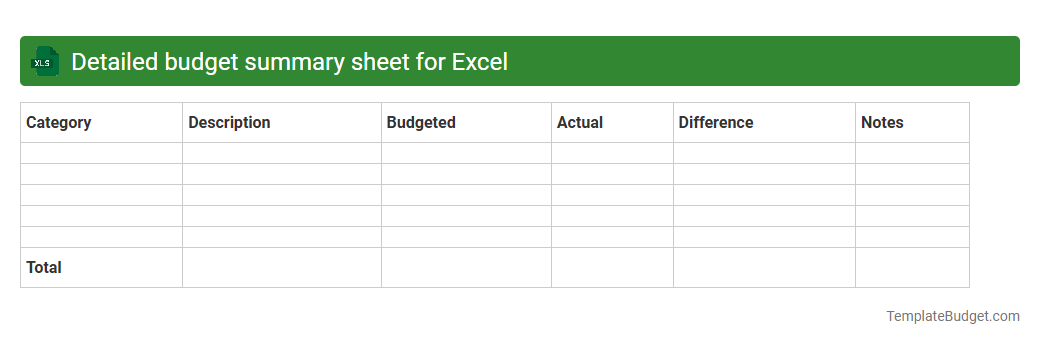

Detailed budget summary sheet for Excel

A detailed budget summary sheet in Excel typically includes categorized expense and income items, monthly and annual totals, and variance analysis for tracking budget versus actual spending. It often contains formulas for automatic calculations, pivot tables for data summarization, and charts enhancing visual interpretation of financial data. Key elements may include predefined headers, subtotals, conditional formatting for anomalies, and notes for budget assumptions or justifications.

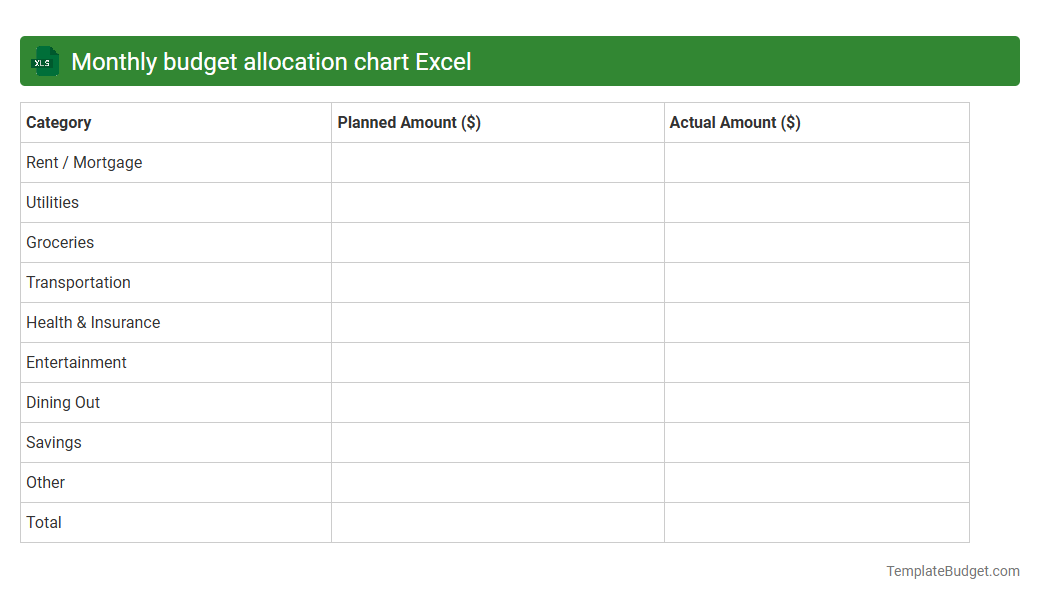

Monthly budget allocation chart Excel

An Excel document titled "Monthly Budget Allocation Chart" typically contains detailed tables listing income sources, expense categories, and allocated budget amounts for each month. It often includes formulas to calculate totals, variances, and percentages reflecting spending patterns and financial balances. Visual elements like pie charts or bar graphs are embedded to provide a clear overview of budget distribution and financial planning.

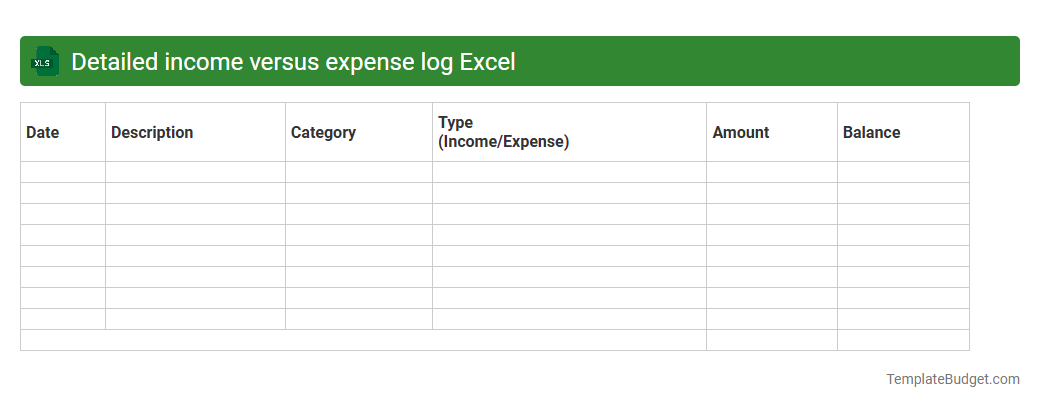

Detailed income versus expense log Excel

An Excel document titled "Detailed Income versus Expense Log" typically contains structured columns including dates, income sources, expense categories, amounts, payment methods, and notes for transaction details. Rows list individual financial entries, allowing for tracking cash inflows and outflows with clear distinctions between different types of income and expenses. Formulas and pivot tables are often embedded to calculate totals, differences, and generate summaries for efficient budget management and financial analysis.

Introduction to Detailed Monthly Budget Excel Templates

A Comprehensive Monthly Budget Excel Template is designed to help individuals manage their finances effectively by organizing income, expenses, and savings in one place. These templates provide a clear, customizable framework that simplifies budget tracking and financial planning. Using an Excel-based tool enhances accessibility and ease of use for users of all experience levels.

Key Features of a Monthly Budget Excel Template

Monthly budget templates typically include pre-built categories for income and expenses, dynamic formulas for automatic calculations, and summary dashboards that show financial health at a glance. Many templates offer customizable sections, allowing you to tailor the spreadsheet to your unique financial situation. Conditional formatting and data validation further enhance usability and error reduction.

Benefits of Using an Excel Budget Template

Utilizing an Excel budget template aids in precise expense tracking and helps identify spending patterns to improve saving habits. It offers flexibility to update and adjust budgets in real-time, promoting proactive money management. Moreover, the ability to generate quick reports supports informed decision-making and goal setting.

Essential Categories to Include in Your Budget

Important budget categories should cover fixed expenses like rent and utilities, variable costs such as groceries and entertainment, and savings or debt repayments. Including a separate section for emergency funds strengthens financial security. Accurate categorization ensures a comprehensive overview of your monthly financial commitments.

Step-by-Step Guide to Setting Up Your Budget Template

Begin by inputting all sources of income followed by recurring and expected expenses into relevant categories. Next, configure formulas to calculate totals and net balances automatically. Finally, set financial targets and review your budget monthly to track progress and make necessary adjustments.

Customization Tips for Personal Finance Needs

Tailor your budget by adding or removing categories that reflect your lifestyle and financial goals. Use color-coding to differentiate between fixed and variable expenses for better visualization. Incorporating personal savings targets or investment tracking columns increases the template's effectiveness and personal relevance.

Tracking Income and Expenses Effectively

Consistent daily or weekly entry of financial transactions ensures your budget remains accurate and up to date. Utilizing features like drop-down lists and automatic calculations minimizes errors and saves time. Regular expense reviews empower you to maintain control over your cash flow and identify areas for improvement.

Visualizing Data with Excel Charts and Graphs

Excel's charting tools allow users to create pie charts, bar graphs, and trend lines that illustrate income distribution and spending patterns clearly. This visual representation facilitates quick assessment of financial health and aids in communicating your budget status. Dynamic charts update automatically, providing immediate insights after data entry.

Common Mistakes to Avoid in Monthly Budgeting

Avoid underestimating expenses or neglecting irregular costs like annual subscriptions. Failure to review and adjust the budget regularly can lead to inaccuracies and financial strain. Ignoring savings goals diminishes the effectiveness of budgeting in building a secure financial future.

Free and Premium Monthly Budget Excel Template Resources

Many websites offer a variety of free and premium Monthly Budget Excel Templates tailored for different financial situations, complete with varying levels of complexity. Premium templates often include advanced features like debt payoff planners and investment tracking. Exploring these options helps you find the perfect tool to suit your budget management style.

More Monthly Excel Templates