Creating an annual household budget helps track income, expenses, and savings effectively, ensuring financial stability throughout the year. Understanding key categories such as utilities, groceries, debt payments, and discretionary spending enables better money management and long-term planning. Explore the comprehensive Excel template below to start organizing your finances with ease.

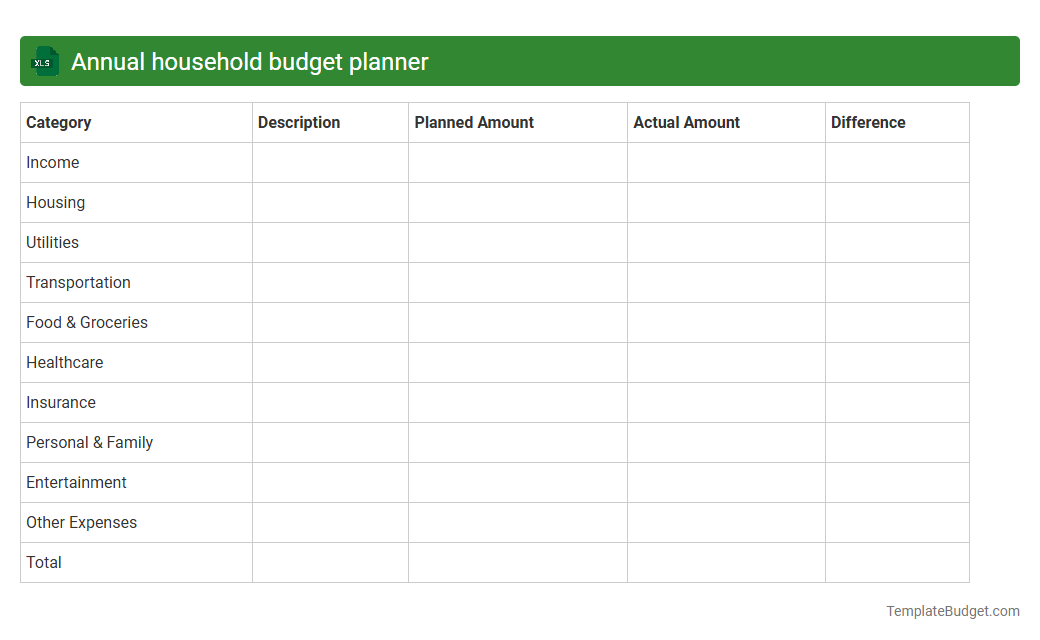

Annual household budget planner

An annual household budget planner Excel document typically contains categorized expense and income sections, including fixed costs like mortgage or rent, utilities, and insurance, alongside variable expenses such as groceries, transportation, and entertainment. It features monthly columns for tracking actual versus planned spending, formulas to calculate total income, expenses, and net savings, as well as charts or graphs to visualize budget trends throughout the year. The workbook may also include debt repayment schedules, savings goals, and summary sheets for quick financial overview and planning.

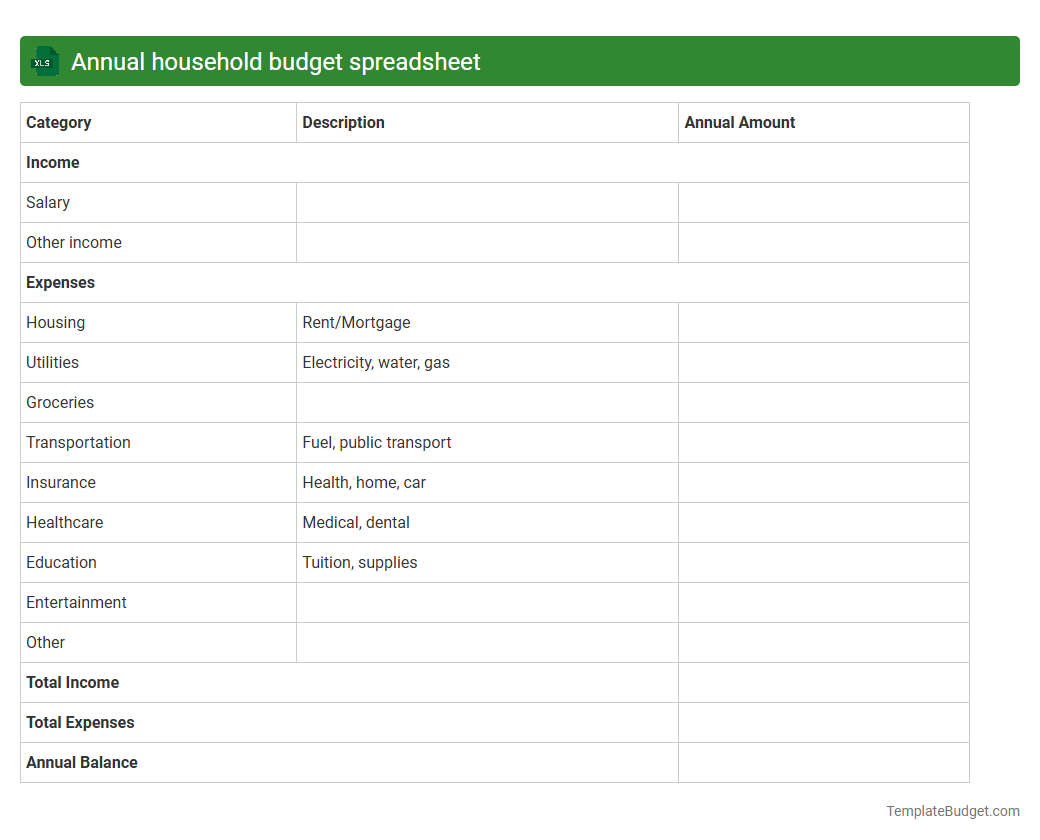

Annual household budget spreadsheet

An annual household budget spreadsheet typically contains categorized sections for income sources, fixed expenses such as rent or mortgage, utilities, and variable costs like groceries and entertainment. It often includes monthly columns to track actual versus projected spending, enabling identification of patterns and adjustments throughout the year. Formulas summarize totals, calculate savings, and generate visual charts for clear financial insights.

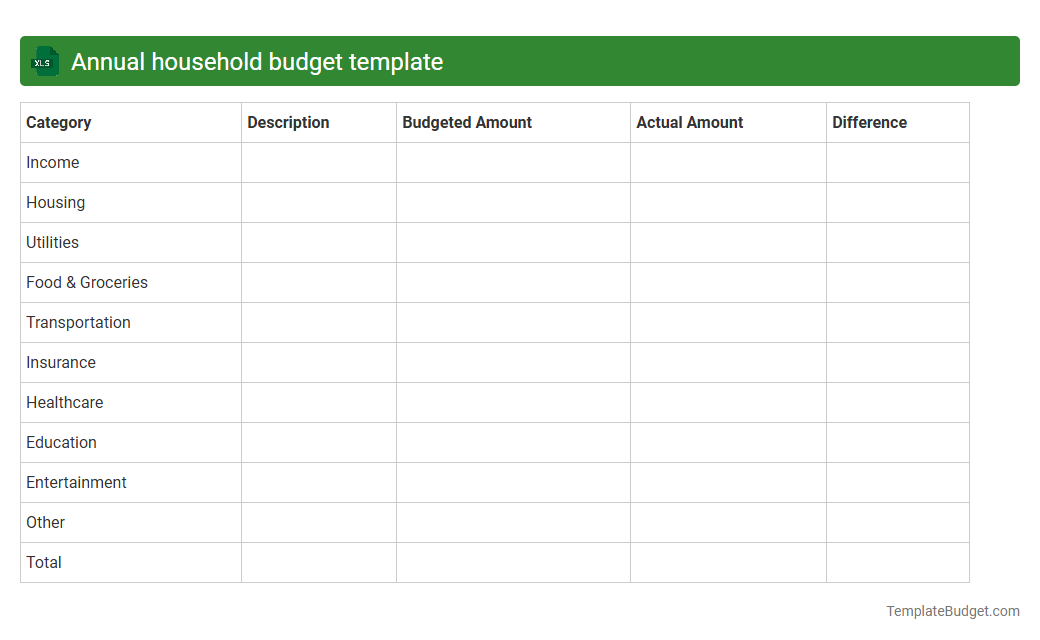

Annual household budget template

An Excel document for an annual household budget template typically contains categorized expense and income sections, including monthly and yearly totals. It features customizable columns for rent or mortgage, utilities, groceries, transportation, insurance, and savings, along with graphs or charts to visualize spending trends. Formulas automate calculations, enabling users to track financial goals and adjust budgets effectively over the 12-month period.

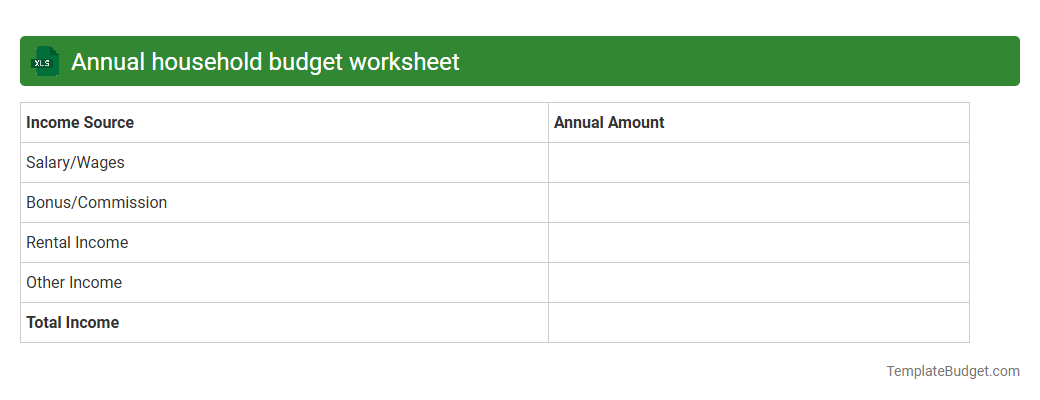

Annual household budget worksheet

An annual household budget worksheet in Excel typically includes categorized expense sections such as housing, utilities, groceries, transportation, healthcare, and entertainment, with corresponding monthly and yearly cost columns. It often contains formulas that calculate total expenses, income, savings, and variance analysis to help track financial goals. Data visualization features like charts and graphs may be embedded to provide clear insights into spending patterns and budget adherence.

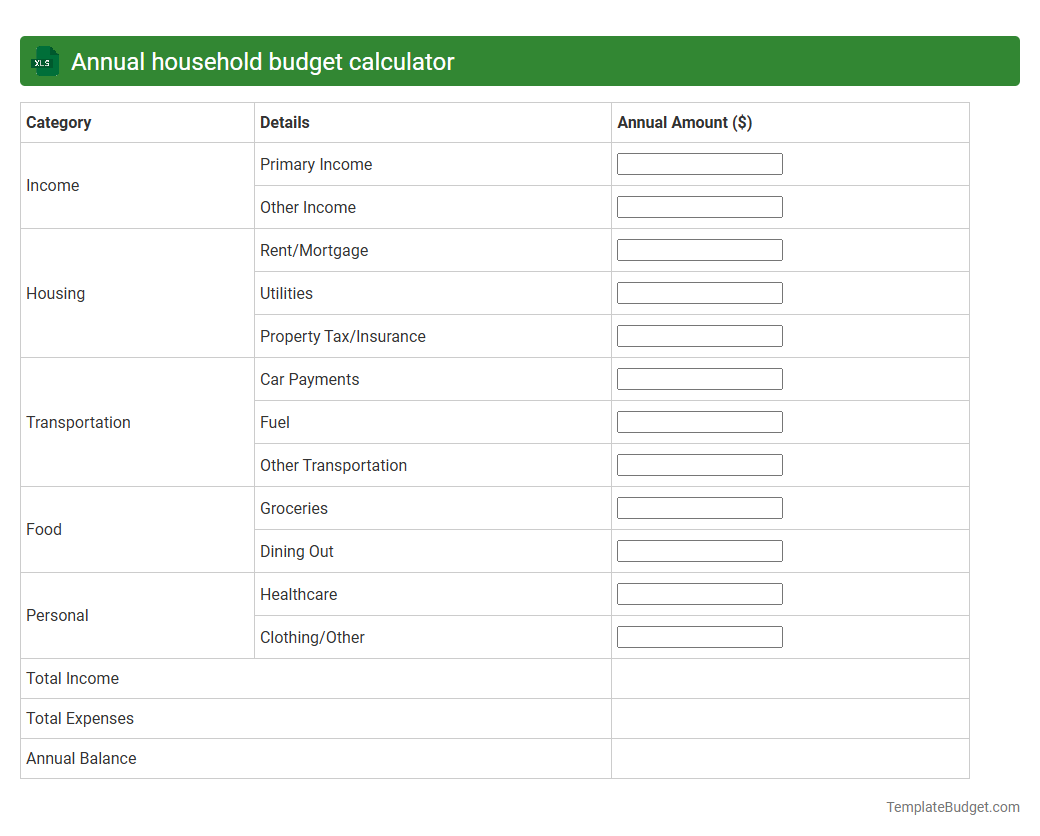

Annual household budget calculator

An Excel document for an annual household budget calculator typically contains categorized expense and income sections, including housing, utilities, groceries, transportation, insurance, and entertainment. It features monthly and yearly totals, formulas for automatic calculations, and charts or graphs to visualize spending patterns. Budget sheets often include adjustable parameters for savings goals, debt repayments, and tax estimations to provide a comprehensive financial overview.

Annual household budget tracker

An annual household budget tracker Excel document typically contains categorized expense fields such as housing, utilities, groceries, transportation, and entertainment, paired with income sources for each month. It includes formulas to calculate monthly totals, compare planned versus actual spending, and generate year-end summaries to identify saving opportunities. Visual elements like charts and graphs enable quick analysis of financial trends and budget adherence throughout the year.

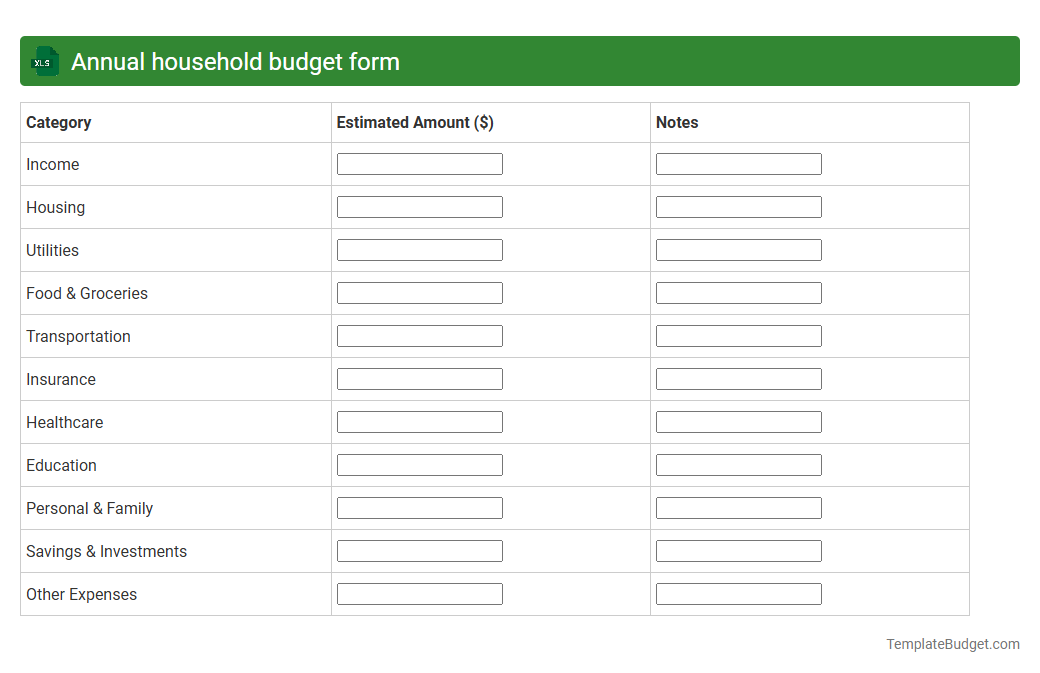

Annual household budget form

An annual household budget form in an Excel document typically contains categorized income sources, fixed and variable expenses, and savings goals organized in separate worksheets or tables. It includes formulas for automatic calculation of monthly totals, yearly summaries, and variance analysis to track spending against budgeted amounts. Graphs and charts are often embedded to visualize cash flow trends, expense distribution, and financial progress throughout the year.

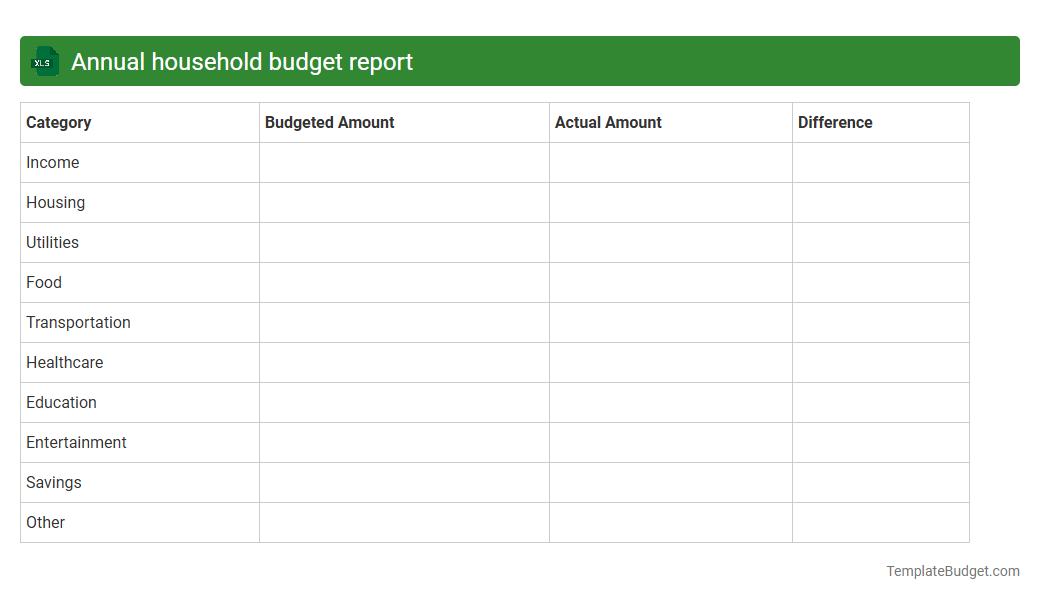

Annual household budget report

An annual household budget report in an Excel document typically contains detailed categories such as income sources, fixed and variable expenses, savings goals, and debt payments. It includes monthly breakdowns and cumulative totals to track financial progress over the year. Formulas and charts are often used to analyze spending patterns and identify opportunities for cost-saving.

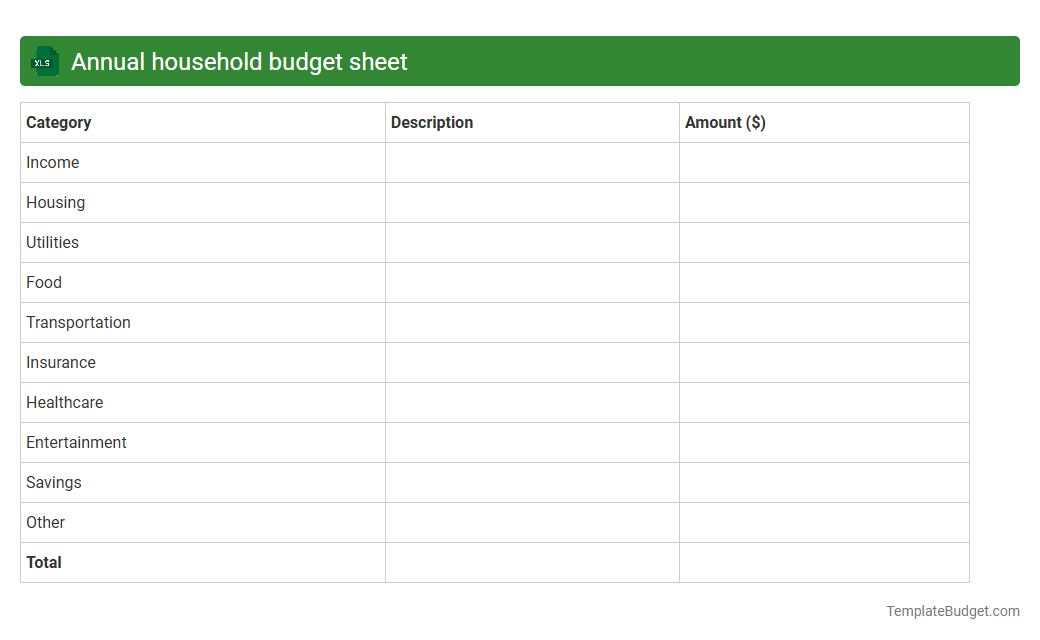

Annual household budget sheet

An annual household budget Excel sheet typically contains categorized expense and income columns, including sections for fixed costs like mortgage or rent, utilities, groceries, transportation, and discretionary spending such as entertainment and dining out. It includes monthly tracking fields that automatically calculate totals, averages, and variance, helping monitor spending patterns against set budgets. Formulas and charts are often embedded for visualizing cash flow trends and identifying potential savings opportunities throughout the year.

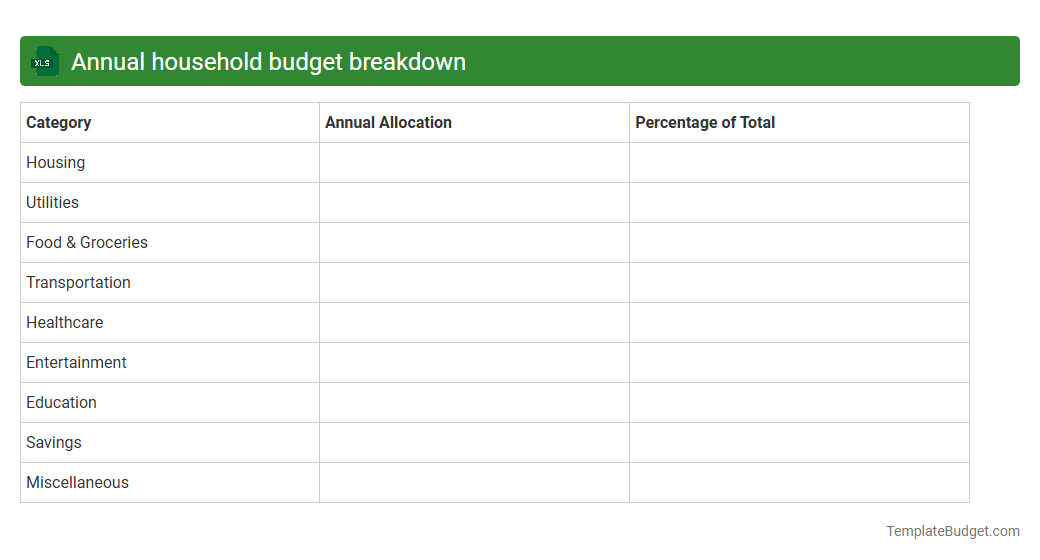

Annual household budget breakdown

An Excel document for an annual household budget breakdown typically contains categorized expense and income data organized monthly, including sections for housing, utilities, groceries, transportation, healthcare, entertainment, savings, and debt payments. It often features formulas to calculate totals, averages, and variances, alongside charts or graphs to visually represent financial trends and yearly expenditure comparisons. This structured layout helps users manage cash flow, identify spending patterns, and plan future financial goals effectively.

Introduction to Annual Household Budgeting

Mastering your annual household budget is essential for achieving financial stability and meeting long-term goals. It involves planning your income and expenses over a 12-month period to ensure you live within your means. This approach helps you anticipate financial needs and plan accordingly.

Benefits of Creating an Annual Household Budget

An annual budget provides a clear overview of your financial situation, allowing for better money management and reduced stress. It helps prevent overspending, encourages savings, and supports debt repayment. Ultimately, this strategic planning empowers you to make informed financial decisions all year long.

Assessing Your Income Sources

Start by accurately identifying all income sources, including salaries, investments, and side jobs. Understanding total earnings enables realistic budget setting and prioritization. Consistent income assessment helps manage cash flow throughout the year.

Categorizing Household Expenses

Break down your spending into fixed, variable, and discretionary expense categories for better clarity. Categorizing expenses allows you to pinpoint areas for potential savings and optimize your budget. Accurate expense tracking supports more effective financial planning.

Setting Financial Goals for the Year

Define specific, measurable, and attainable financial goals to guide your budgeting process. Whether it's saving for a vacation, reducing debt, or building an emergency fund, clear goals motivate disciplined spending. Annual targets help track progress and adjust plans as needed.

Tools and Methods for Budget Tracking

Utilize modern budget tracking tools such as apps, spreadsheets, or professional templates to monitor your finances. These methods increase accuracy and provide real-time insights into your spending habits. Reliable tracking enhances budget compliance and financial control.

Strategies to Reduce Household Expenses

Implement cost-cutting strategies like negotiating bills, reducing utility usage, and prioritizing essential purchases. Cutting unnecessary expenses boosts savings without sacrificing quality of life. Regular expense review uncovers ongoing opportunities for budget improvement.

Dealing with Unexpected Financial Changes

An annual budget should incorporate contingency plans for unexpected financial changes such as job loss or medical emergencies. Maintaining an emergency fund and flexible spending allows resilience during financial shocks. Proactive planning minimizes stress and financial disruption.

Reviewing and Adjusting Your Budget Annually

Conduct an annual review to compare actual performance against your budget and make necessary adjustments. Life changes, inflation, and evolving goals require periodic budget recalibration. Regular reviews ensure your budget stays relevant and effective.

Common Mistakes to Avoid in Annual Budget Planning

Avoid common pitfalls such as underestimating expenses, neglecting irregular payments, and failing to update your budget. Overlooking these can lead to budget shortfalls and financial strain. Staying vigilant and realistic keeps your budget functional and reliable.

More Household Excel Templates