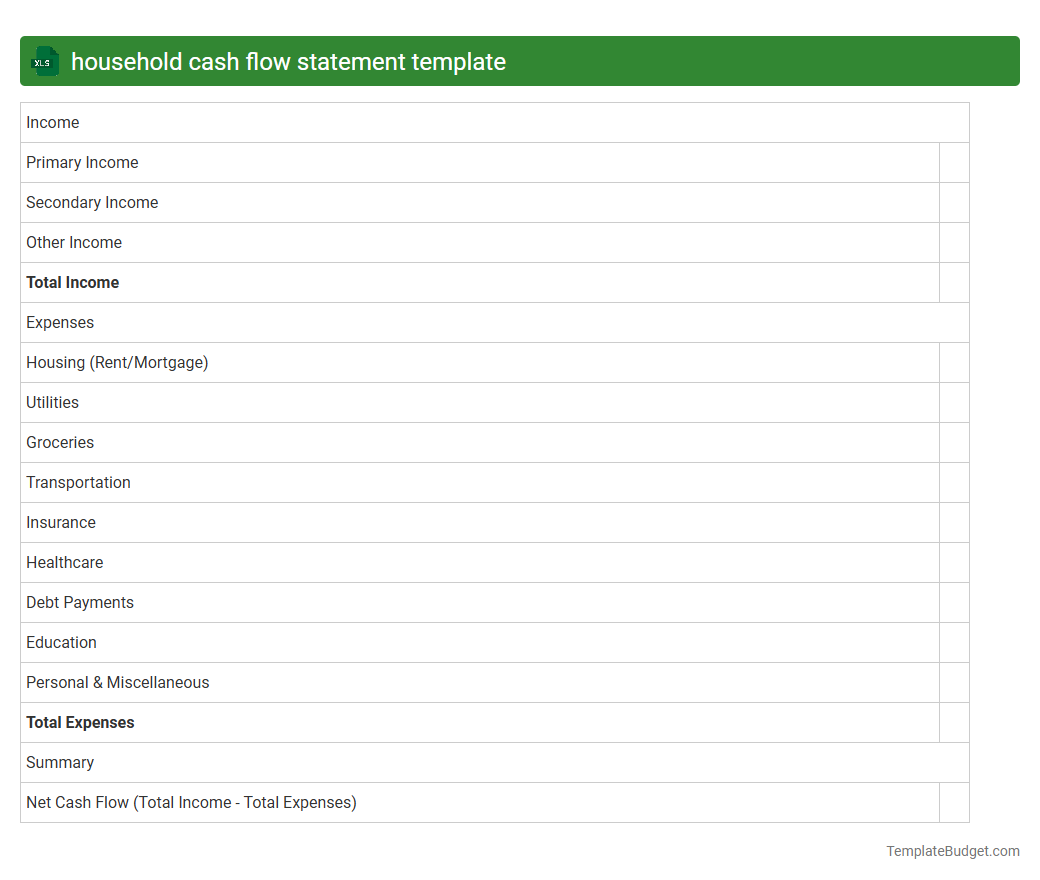

Household cash flow statement template

An Excel household cash flow statement template typically includes sections for income sources such as salaries, investments, and other earnings, along with detailed expense categories like housing, utilities, groceries, transportation, and discretionary spending. It features columns for tracking monthly amounts, running totals, and year-to-date summaries to help users monitor their financial health over time. Built-in formulas calculate net cash flow, allowing individuals to analyze surplus or deficit trends and optimize their budgeting strategies effectively.

Monthly household cash flow tracker

An Excel document for a monthly household cash flow tracker typically includes categorized income sources such as salary, freelance earnings, and investments, alongside expense categories like rent, utilities, groceries, and entertainment. It features columns for planned budgets versus actual spending, enabling users to identify discrepancies and manage finances effectively. Charts and summary tables often visualize monthly cash inflows and outflows, helping to track savings goals and maintain a balanced budget.

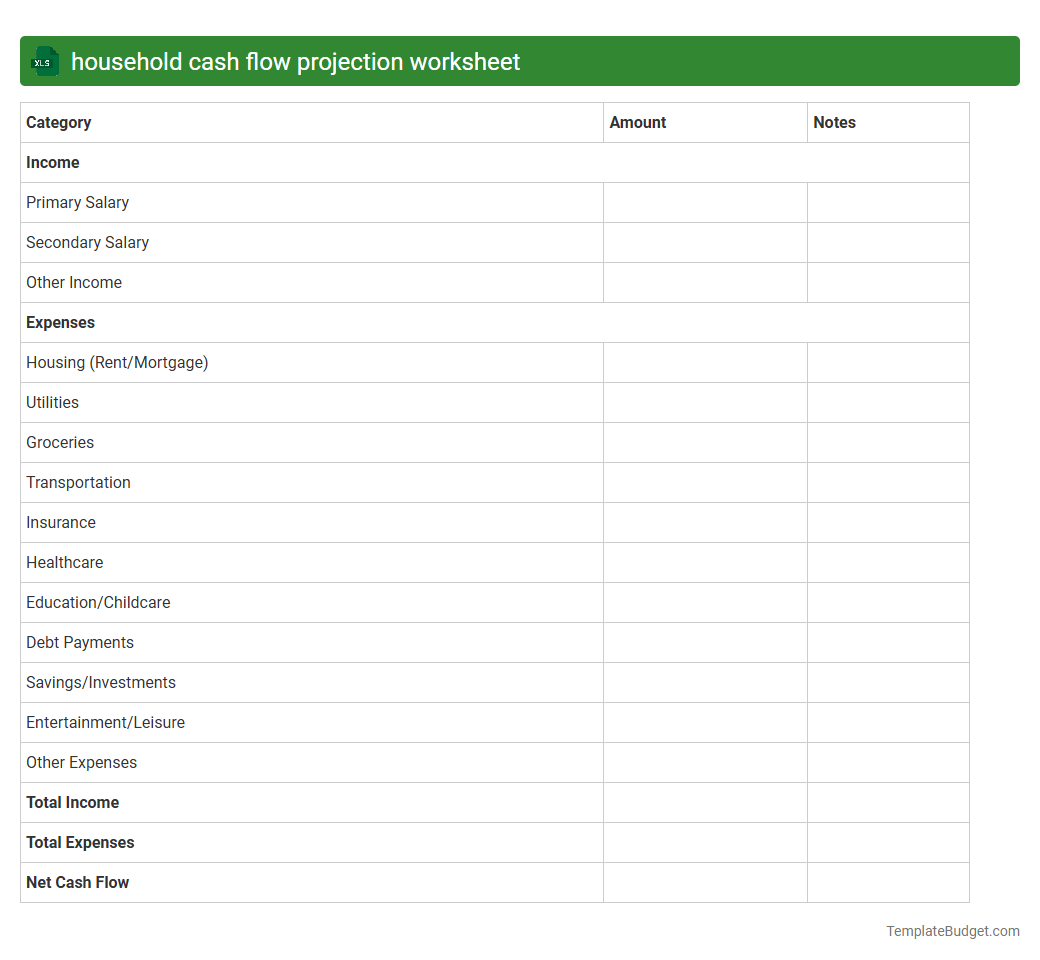

Household cash flow projection worksheet

A household cash flow projection worksheet in an Excel document typically includes detailed sections for income sources such as salaries, investments, and miscellaneous earnings, alongside categorized expenses like housing, utilities, groceries, transportation, and debt payments. It features monthly and annual timelines to project cash inflows and outflows, enabling identification of surplus or deficit periods. Formulas and charts often summarize net cash flow trends, helping users to plan and adjust budgets effectively.

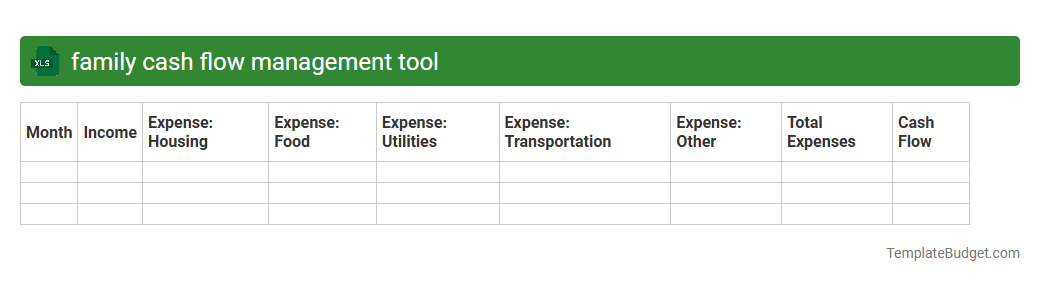

Family cash flow management tool

An Excel family cash flow management tool typically contains categorized income and expense tables, monthly budgeting sheets, and visual charts tracking cash inflows and outflows. It includes formulas to calculate net savings, forecast future balances, and highlight spending patterns for effective financial planning. Often, separate sections for debt tracking, emergency funds, and goal setting support comprehensive household financial oversight.

Personal household cash flow planner

An Excel document for a personal household cash flow planner typically contains spreadsheets that track income sources, monthly expenses, and savings goals. It includes categorized entries like bills, groceries, entertainment, and transportation, alongside calculated totals and balance summaries to monitor financial health. Dynamic charts and formulas often visualize cash inflows and outflows, helping users manage budgets and forecast future financial scenarios effectively.

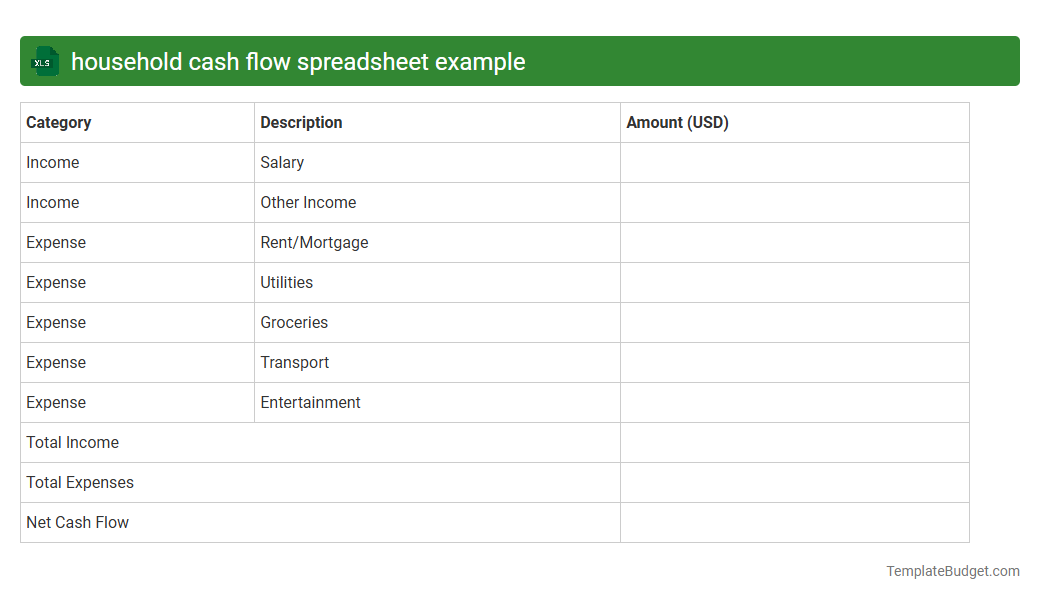

Household cash flow spreadsheet example

An Excel household cash flow spreadsheet typically includes sections for income sources such as salaries, bonuses, and other revenues, alongside expense categories like rent or mortgage, utilities, groceries, transportation, and entertainment. It often features columns for tracking monthly income and expenditures, helping users identify surplus funds or deficits. Formulas and charts within the spreadsheet provide a clear visualization of cash inflows and outflows, enabling effective budgeting and financial planning.

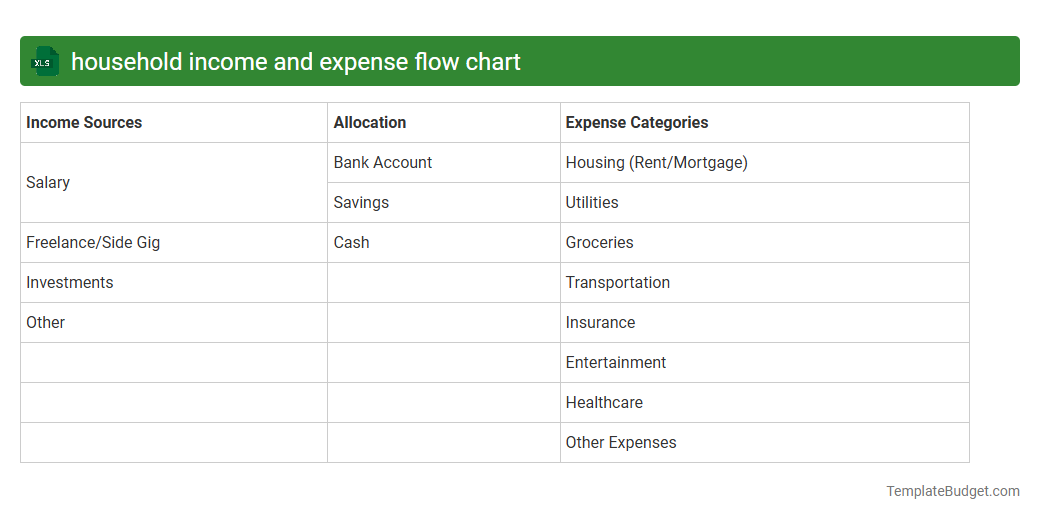

Household income and expense flow chart

An Excel document containing a household income and expense flow chart typically includes categorized data such as monthly income sources, fixed and variable expenses, and savings contributions. It often features detailed line items for utilities, groceries, mortgage or rent, transportation, and discretionary spending, organized into tables for clarity. Visual elements like pie charts or bar graphs are incorporated to illustrate the proportions and trends in household cash flow over time.

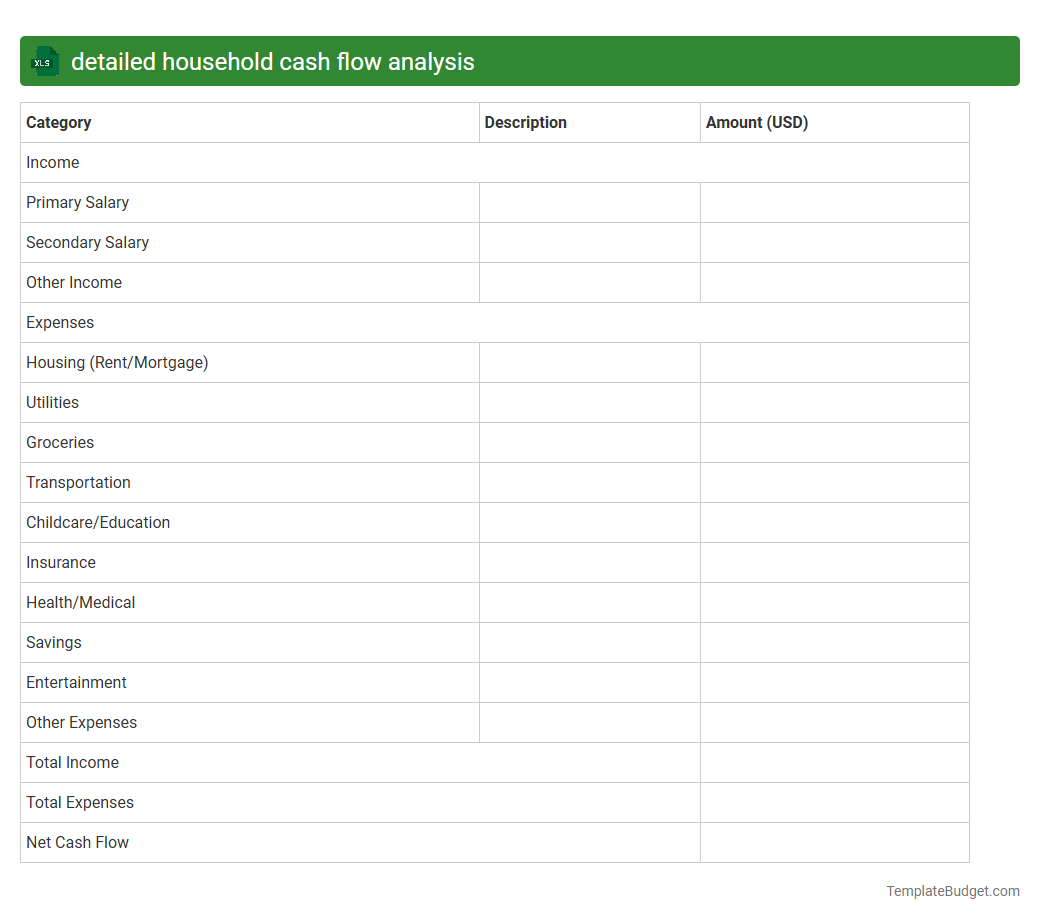

Detailed household cash flow analysis

An Excel document for detailed household cash flow analysis typically includes categorized income sources such as salaries, rental income, and investment returns, alongside recurring expenses like mortgage payments, utilities, groceries, and entertainment. It features monthly tracking sheets, summary dashboards with charts to visualize net cash flow trends, and customizable templates for budgeting and forecasting future financial scenarios. Advanced spreadsheets often incorporate formulas for automatic calculations, debt repayment schedules, and savings goal trackers to provide comprehensive financial insights.

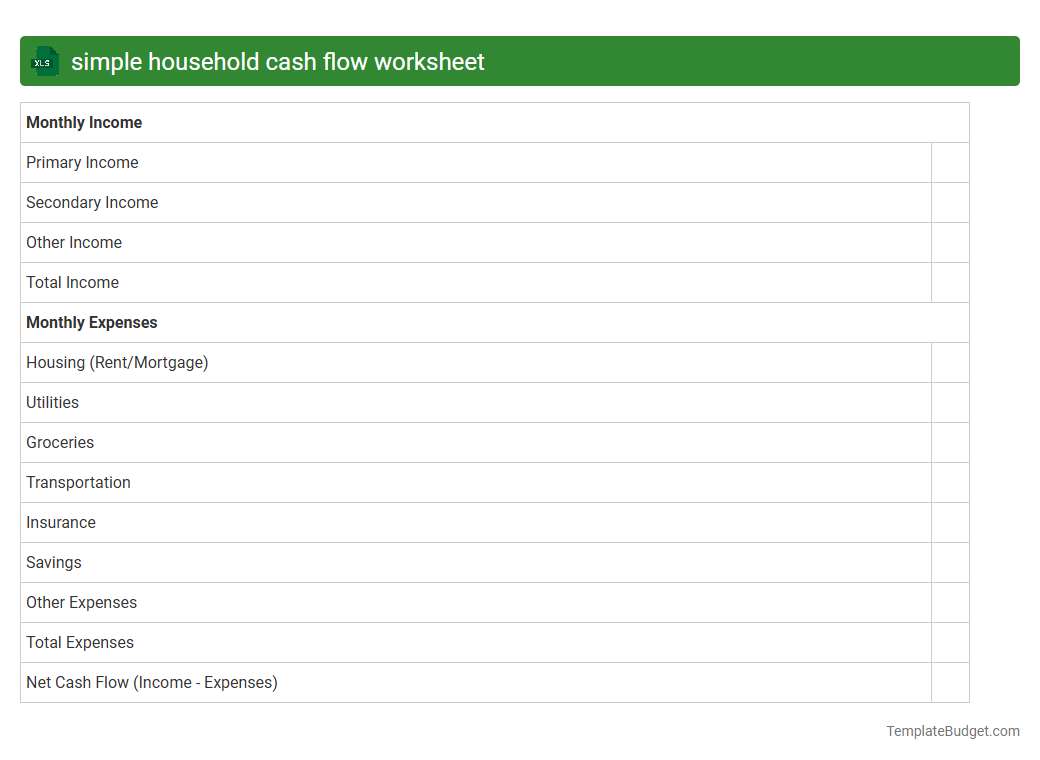

Simple household cash flow worksheet

An Excel household cash flow worksheet typically contains categorized income sources such as salaries, investments, and miscellaneous earnings, alongside detailed expense entries including rent, utilities, groceries, transportation, and entertainment costs. It features columns for tracking monthly amounts, calculating totals, and showing net cash flow to help manage savings and avoid overspending. Common functions like SUM and subtraction formulas automate the aggregation of inflows and outflows, providing a clear overview of financial health.

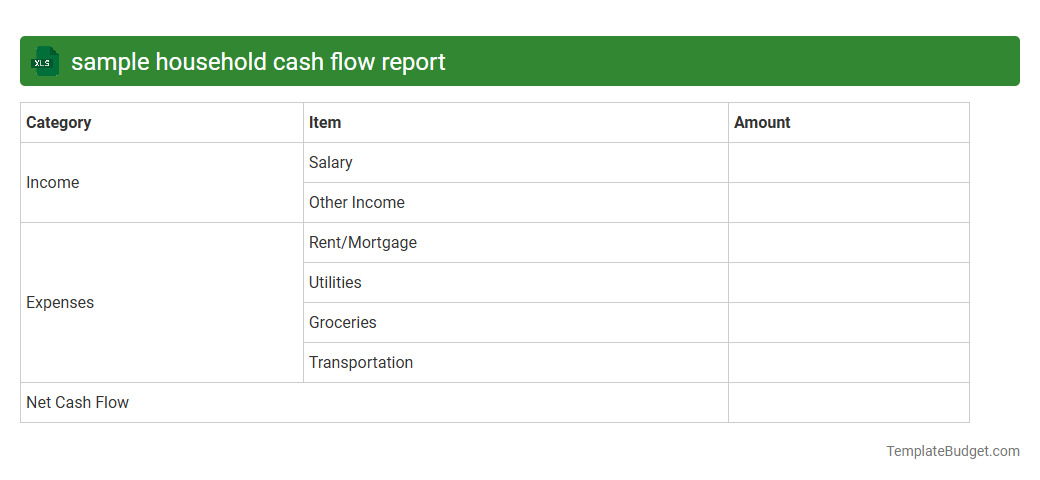

Sample household cash flow report

An Excel document containing a sample household cash flow report typically includes detailed categories such as income sources, fixed and variable expenses, and savings or investments. Each category is often broken down into monthly or weekly entries with corresponding amounts, allowing for clear tracking and analysis of cash inflows and outflows. Formulas and charts are commonly used to summarize net cash flow, highlight trends, and project future financial positions.

Understanding Household Cash Flow

Household cash flow is the movement of money in and out of your home finances. It involves tracking all income and expenses to maintain financial balance. Understanding this flow helps in making informed economic decisions.

Importance of Tracking Cash Flow

Tracking cash flow ensures you know exactly where your money goes each month. It prevents overspending and helps in identifying wasteful habits. Accurate tracking is essential for achieving financial stability.

Common Sources of Household Income

Income sources typically include salaries, bonuses, rental income, and investments. Knowing all income streams provides a clear picture of total household funds. This understanding is crucial for creating an effective cash flow plan.

Typical Household Expenses

Routine expenses involve housing, utilities, groceries, transportation, and entertainment. Categorizing these expenses aids in better budgeting. Controlling these costs is key to maintaining a positive cash flow.

Creating a Cash Flow Statement

A cash flow statement lists all income and expenses over a specific period. It highlights your net cash position by subtracting expenses from income. This document is vital for financial clarity.

Tips for Managing Household Cash Flow

Effective management includes budgeting, tracking expenses, and prioritizing payments. Regular review of cash flow ensures you stay within limits. Implementing these tips strengthens financial discipline.

Identifying Cash Flow Problems

Signs of cash flow issues include frequent overdrafts, unpaid bills, and reliance on credit. Recognizing these early helps prevent financial crises. Addressing problems promptly is critical for financial health.

Tools and Apps for Cash Flow Management

Modern tools like budgeting apps and financial software simplify tracking. They offer automation and real-time updates for better control. Utilizing these tools enhances cash flow efficiency.

Strategies to Improve Cash Flow

Improvement strategies include increasing income, reducing expenses, and debt management. Periodic evaluation and adjustment optimize household finances. Applying these strategies leads to stronger financial growth.

Setting Financial Goals Based on Cash Flow

Cash flow data helps set realistic short and long-term financial goals. Goals might include savings targets, debt reduction, or investment plans. Aligning goals with cash flow ensures achievable financial objectives.