Accurately planning your startup's finances before launching is crucial for long-term success, making a detailed pre-opening budget essential. This budget helps track initial expenses, forecast cash flow, and allocate resources effectively to avoid common financial pitfalls. Explore the Startup Pre-Opening Budget Excel Template below to streamline your financial planning process.

Startup Pre-Opening Budget Spreadsheet

A Startup Pre-Opening Budget Spreadsheet typically includes detailed projections of initial expenses such as equipment purchases, marketing costs, permits, and staffing salaries. It organizes cash flow forecasts, capital investments, and contingency funds to ensure financial preparedness before launch. The spreadsheet also tracks vendor payments, overhead costs, and anticipated revenue to support comprehensive budget management.

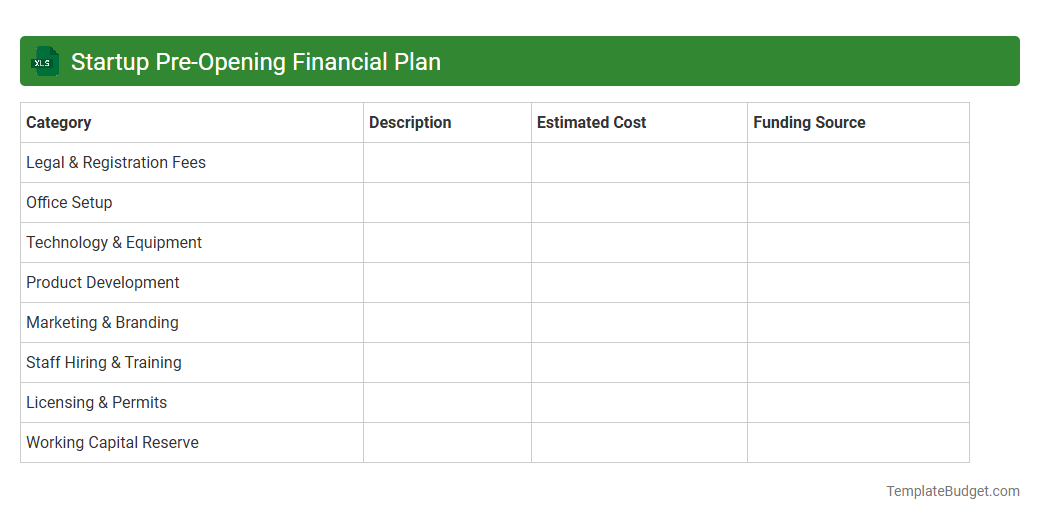

Startup Pre-Opening Financial Plan

The Startup Pre-Opening Financial Plan Excel document typically includes detailed projections of capital requirements, monthly operating expenses, and anticipated revenue streams before business launch. It contains worksheets for cash flow statements, profit and loss forecasts, break-even analysis, and funding sources, allowing entrepreneurs to map out financial needs and timelines. Key data points often feature startup costs, marketing budgets, staffing expenses, and sales forecasts to support decision-making and secure investor funding.

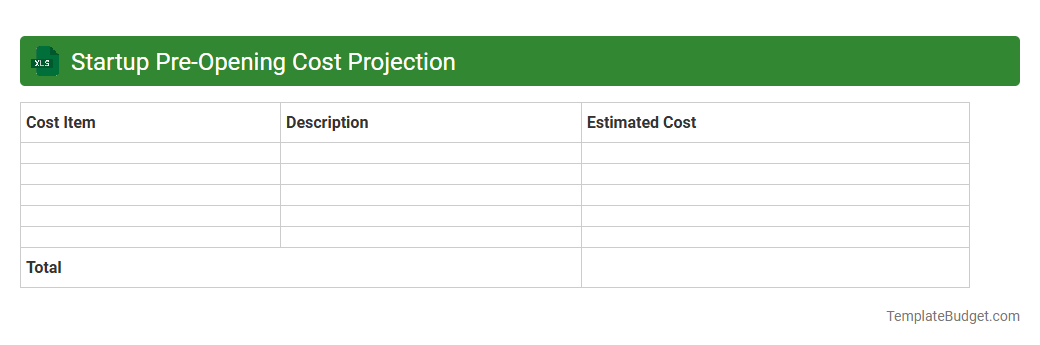

Startup Pre-Opening Cost Projection

An Excel document for a Startup Pre-Opening Cost Projection typically includes detailed line items such as equipment purchases, initial inventory, marketing expenses, legal fees, and staffing costs. It features categorized cost sections, timelines for expenditure, and formulas that calculate total projected costs and cash flow requirements. This structured financial planning tool helps entrepreneurs estimate the capital needed before launching operations and prepare investor presentations.

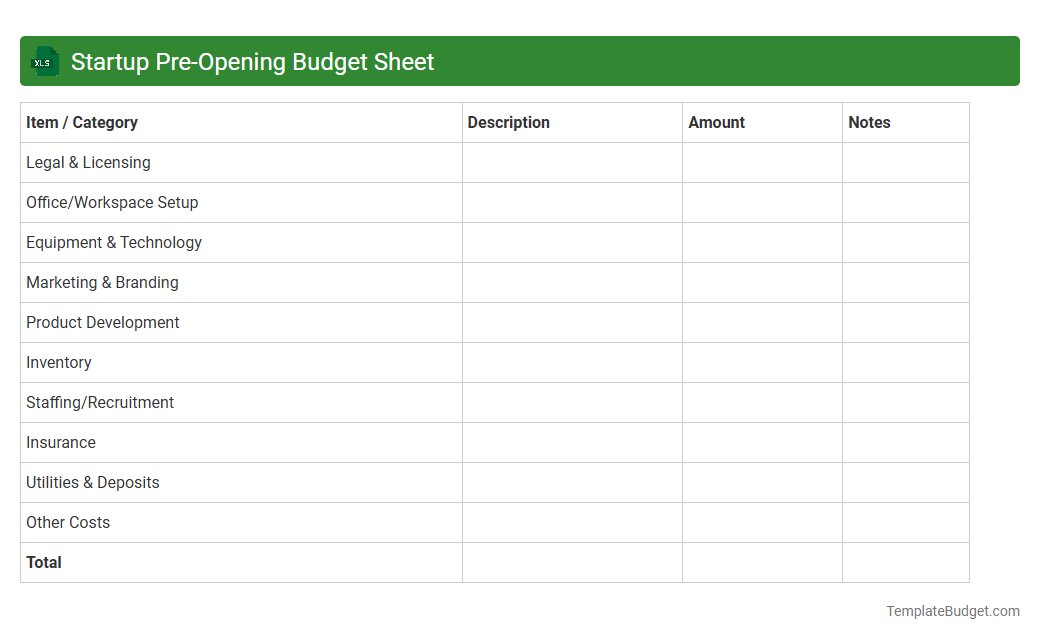

Startup Pre-Opening Budget Sheet

A Startup Pre-Opening Budget Sheet in Excel typically contains detailed projections of initial expenses, including equipment purchases, marketing costs, legal fees, and employee salaries. It organizes these costs into categories such as fixed expenses, variable costs, and one-time investments to provide a clear financial overview. The sheet often includes formulas for total budget calculation, cash flow estimates, and contingency funds to assist in effective financial planning before business launch.

Startup Pre-Opening Expense Tracker

An Excel document titled Startup Pre-Opening Expense Tracker typically contains detailed categories such as initial costs for equipment, permits, licenses, marketing, and employee training. It includes columns for budgeted amounts, actual expenses, payment dates, and vendor information to monitor cash flow and ensure financial control. Formulas and charts are often embedded to provide real-time summaries and visual insights into spending patterns before the business launch.

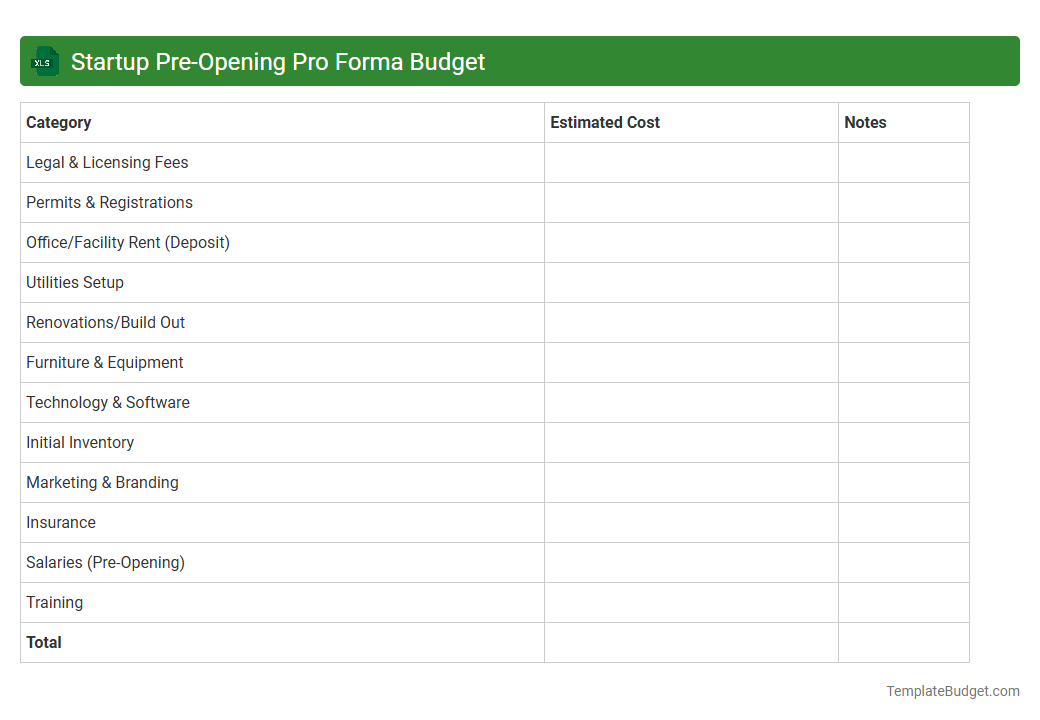

Startup Pre-Opening Pro Forma Budget

An Excel document titled Startup Pre-Opening Pro Forma Budget typically contains detailed financial projections including estimated startup costs, operating expenses, and revenue forecasts. It features categorized expense line items such as equipment purchases, rent, salaries, marketing, and utilities, alongside month-by-month cash flow statements and break-even analysis. This spreadsheet supports decision-making by providing a structured overview of anticipated capital requirements and timelines before business launch.

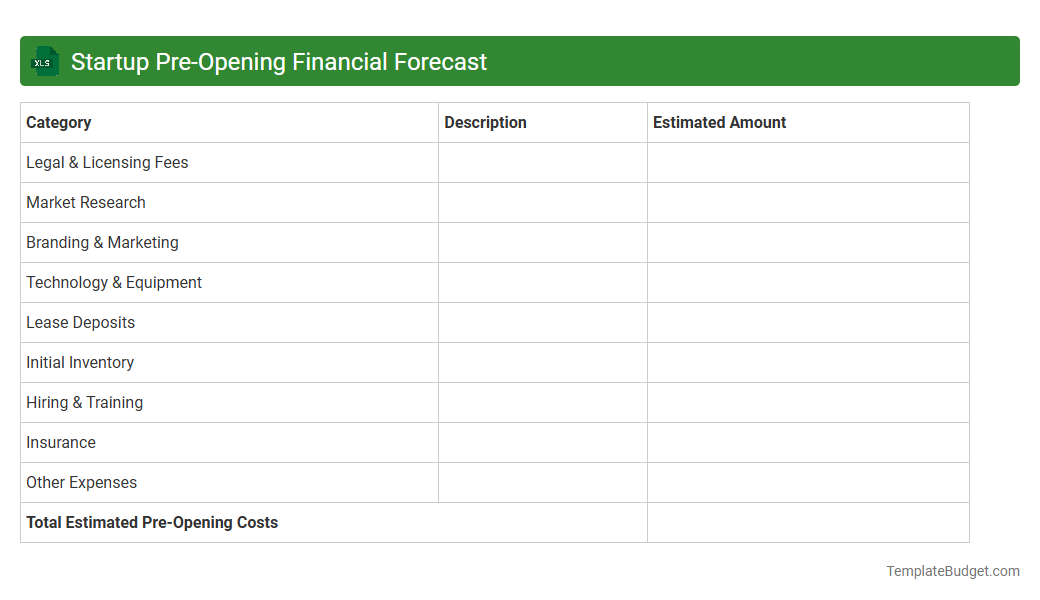

Startup Pre-Opening Financial Forecast

An Excel document titled "Startup Pre-Opening Financial Forecast" typically contains detailed projections of initial capital requirements, anticipated revenue streams, and expense categories such as rent, salaries, marketing, and inventory costs. It includes cash flow statements, break-even analysis, and key financial ratios to assess viability before business launch. These forecasts support strategic planning by providing data-driven insights into the startup's expected financial performance during the pre-opening phase.

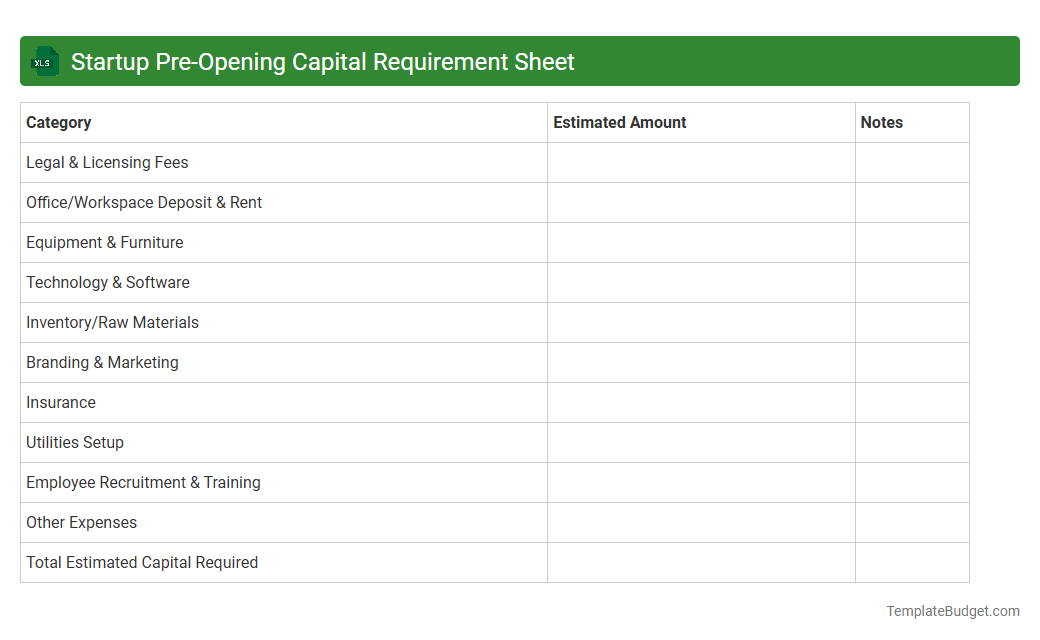

Startup Pre-Opening Capital Requirement Sheet

A Startup Pre-Opening Capital Requirement Sheet in Excel typically contains detailed cost categories such as equipment purchases, licensing fees, initial inventory, marketing expenses, and staffing costs. It often includes columns for estimated amounts, actual expenses, and variance analysis to track budget adherence. Financial projections and funding sources sections help entrepreneurs plan and secure necessary capital before launching their business.

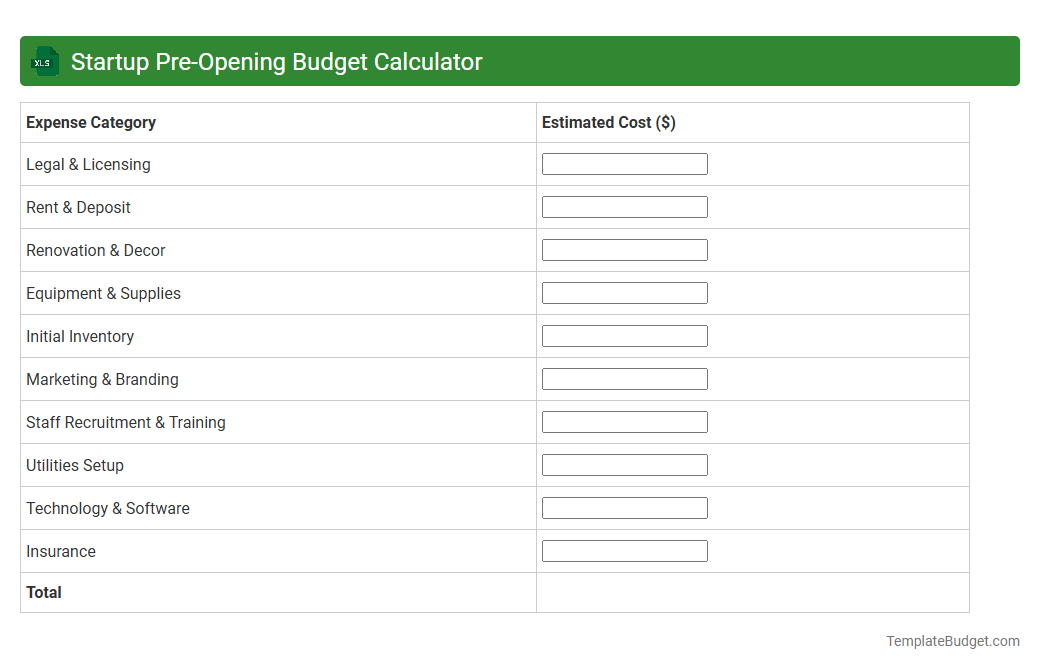

Startup Pre-Opening Budget Calculator

An Excel document titled "Startup Pre-Opening Budget Calculator" typically contains detailed worksheets for estimating initial business expenses, including fixed costs like rent and equipment, and variable costs such as inventory and marketing. It often features predefined formulas to calculate total startup capital requirements, cash flow projections, and break-even analysis. These calculators help entrepreneurs optimize financial planning by providing a comprehensive, customizable overview of anticipated expenditures before launching their startup.

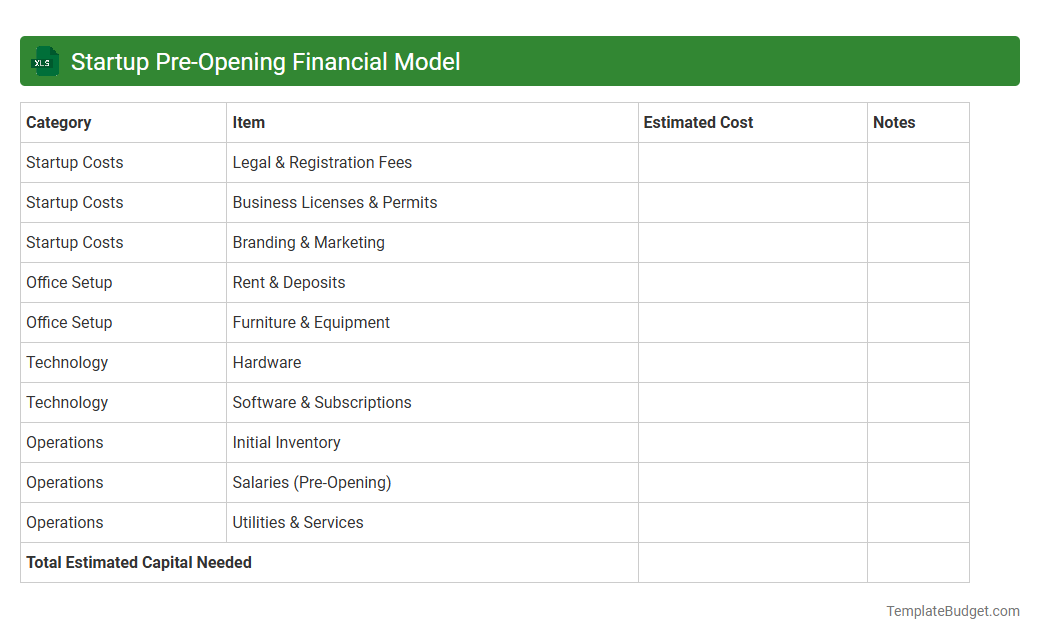

Startup Pre-Opening Financial Model

An Excel document titled "Startup Pre-Opening Financial Model" typically contains detailed financial projections including startup costs, revenue forecasts, and expense estimates to assess business viability before launch. It includes sections like cash flow statements, profit and loss forecasts, and break-even analysis to guide strategic planning and funding requirements. Key financial metrics, such as burn rate and runway, are often integrated to monitor the startup's financial health during the pre-opening phase.

Introduction to Startup Pre-Opening Budgeting

Pre-opening budgeting is a critical process for startups to estimate initial costs and secure funding before launching. It ensures a comprehensive financial plan that guides spending and resource allocation. Using a pre-opening budget enables startups to anticipate expenses and avoid cash flow issues early on.

Key Components of a Pre-Opening Budget

The budget typically includes categories such as equipment, marketing, staffing, rent, and licenses. It's essential to break down these costs for a clear financial overview. Accurately accounting for all key components helps prevent unexpected expenses during startup launch.

Why Use an Excel Template for Budgeting

An Excel template offers flexibility, ease of use, and the ability to update figures instantly. It simplifies tracking and comparing estimated vs. actual expenses, enhancing financial control. The Excel template maximizes efficiency in managing startup budgets.

Essential Features of the Excel Template

A good template includes predefined categories, automatic calculations, customizable fields, and summary dashboards. These features help streamline data entry and provide a clear snapshot of the budget status. The most effective templates provide essential features for thorough financial management.

Step-by-Step Guide to Using the Template

Start by entering your startup's details and projected costs for each category. Update the template regularly as quotes and expenses solidify, ensuring accuracy over time. Following a step-by-step guide simplifies the budgeting process and fosters confidence in financial planning.

Common Pre-Opening Expenses to Include

Remember to budget for rent, utilities, equipment, permits, marketing, and staff recruitment. Overlooking these common costs can derail your financial planning prematurely. Accurately identifying common pre-opening expenses ensures budget completeness.

Customizing the Template for Your Startup

Modify expense categories to reflect your unique business model and growth plans. Tailoring the template allows for precise alignment with your specific operational needs. Customization is key to making the template truly useful and relevant.

Tips for Accurate Budget Forecasting

Use conservative estimates and factor in contingencies to avoid surprises. Regularly comparing budgeted vs. actual costs improves forecasting accuracy over time. Incorporate these tips to maintain realistic and reliable budget projections.

Avoiding Common Budgeting Mistakes

Common errors include underestimating costs, ignoring variable expenses, and failing to update the budget. Staying vigilant against these mistakes improves financial discipline and planning. Learning to avoid common budgeting mistakes is essential for startup success.

Download and Get Started with Your Template

Access the comprehensive pre-opening budget Excel template and 10 key startup document templates today. Begin organizing your financials with professional tools designed for entrepreneurs. Downloading the template is your first step toward a well-planned launch.

More Startup Excel Templates