Efficient management of retirement funds requires a strategic approach to ensure financial stability and peace of mind. A pension budget planner helps individuals track income, expenses, and savings to optimize their retirement strategy. Explore the Excel template below to start organizing your pension budget effectively.

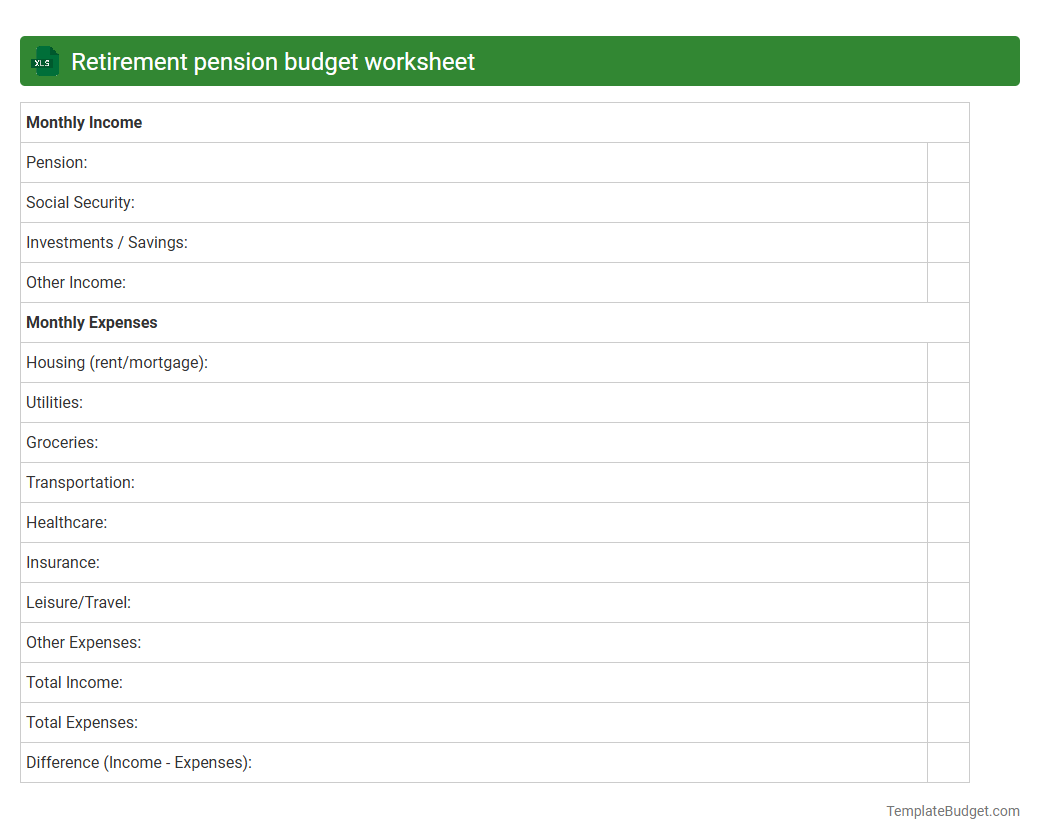

Retirement pension budget worksheet

A Retirement Pension Budget worksheet in Excel typically contains detailed sections for income sources such as Social Security benefits, employer pensions, and personal retirement savings. It includes expense categories like housing, healthcare, food, and leisure activities, alongside formulas to calculate monthly and annual totals. The worksheet often features projection models to estimate future pension fund growth and inflation adjustments, ensuring accurate retirement financial planning.

Pension expense tracking sheet

An Excel pension expense tracking sheet typically contains detailed columns for employee names, pension contribution amounts, dates of payments, and total accrued expenses. It includes formulas to calculate monthly, quarterly, or annual pension costs, helping ensure accurate financial forecasting and compliance with retirement plan obligations. This sheet often integrates charts or pivot tables for visualizing trends in pension liabilities and expenses over time.

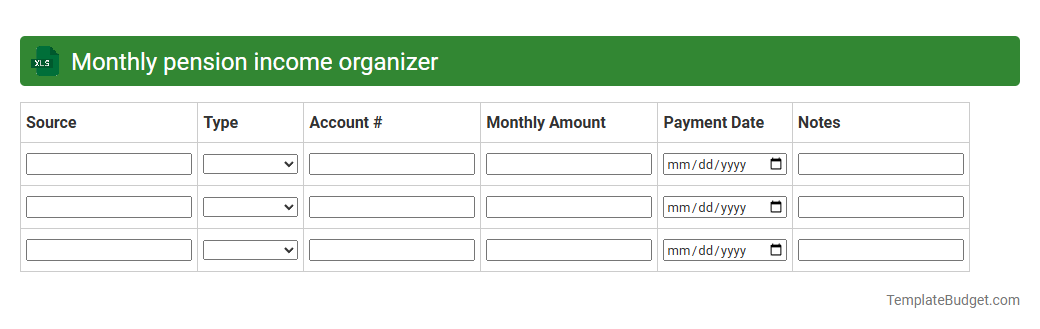

Monthly pension income organizer

An Excel document for a Monthly Pension Income Organizer typically includes worksheets with detailed tables showing pension sources, payment schedules, and amounts received each month. It may also feature columns for tracking deductions, tax withholdings, and net income totals, along with charts summarizing income trends over time. Formulas automate calculations for cumulative earnings and projections, helping users manage and plan their retirement finances efficiently.

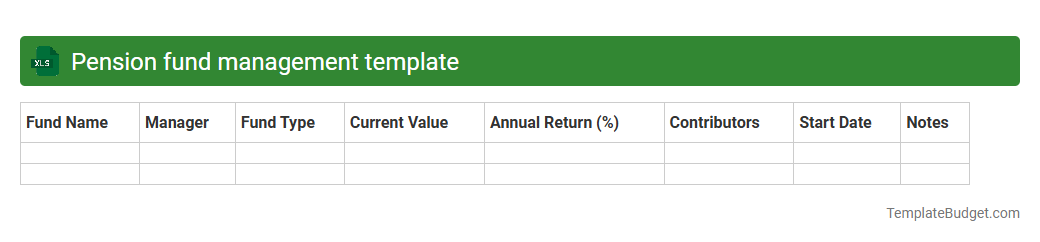

Pension fund management template

An Excel document for pension fund management typically contains detailed sheets for tracking contributions, investment portfolios, and fund performance over time. It includes columns for employee data, contribution amounts, fund allocation percentages, and projected growth calculations based on historical return rates. Embedded formulas and charts provide visualizations of fund health, enabling precise monitoring and strategic decision-making.

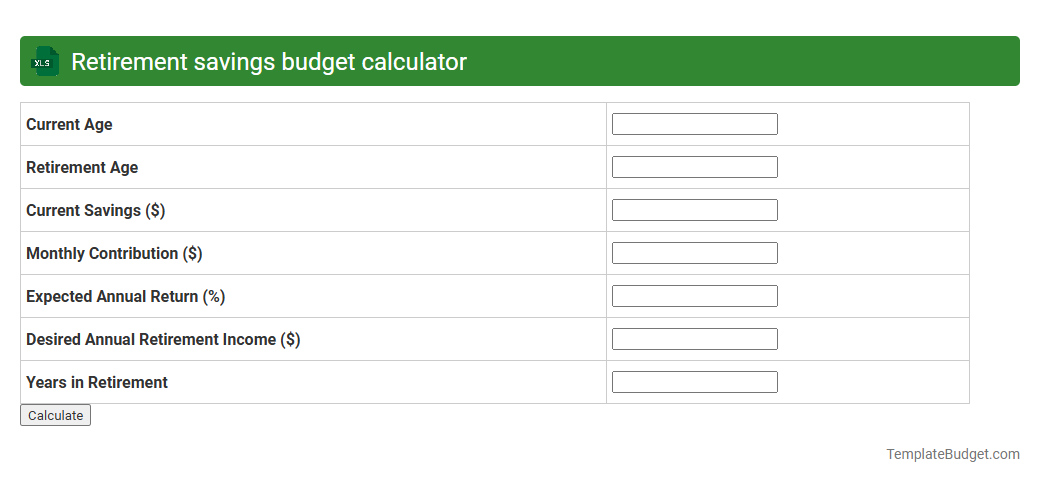

Retirement savings budget calculator

An Excel document titled "Retirement Savings Budget Calculator" typically contains spreadsheets with input fields for age, current savings, monthly contributions, expected retirement age, and estimated annual expenses. It includes formulas to project future savings growth based on interest rates and inflation adjustments, enabling users to visualize their retirement readiness. Graphs and summary tables provide a clear overview of savings milestones and budget allocations for informed financial planning.

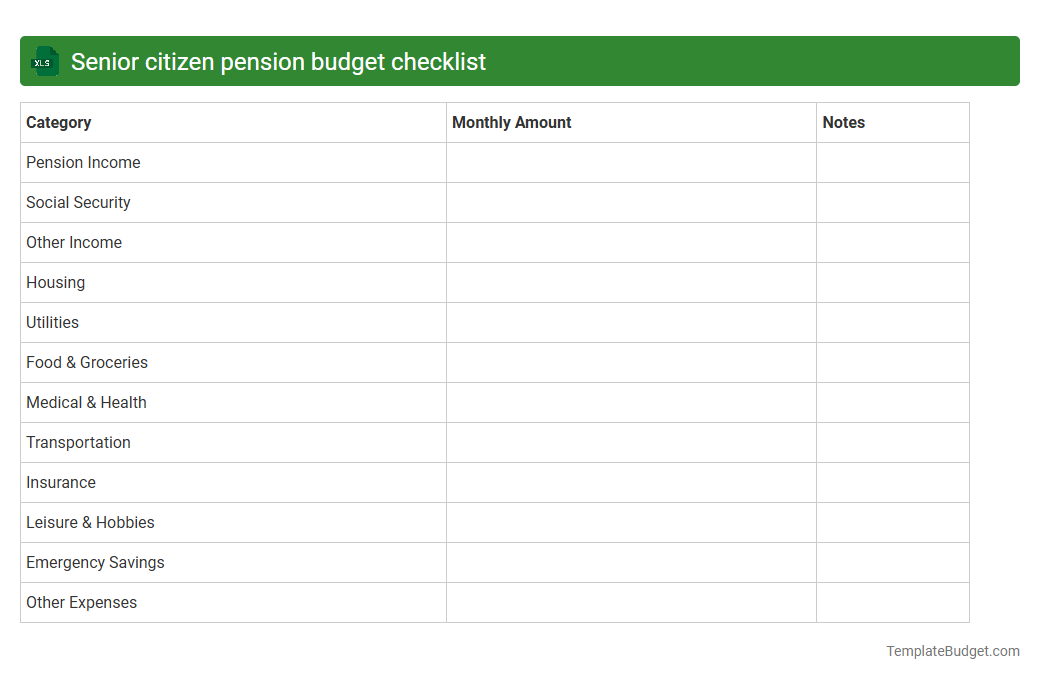

Senior citizen pension budget checklist

A Senior Citizen Pension Budget Checklist Excel document typically contains categorized expense sections such as healthcare, housing, utilities, groceries, transportation, and leisure activities. It includes columns for estimated costs, actual spending, and variances to track monthly or annual pension budget management. Formulas may calculate total expenditures, remaining funds, and savings goals to ensure efficient financial planning for retirees.

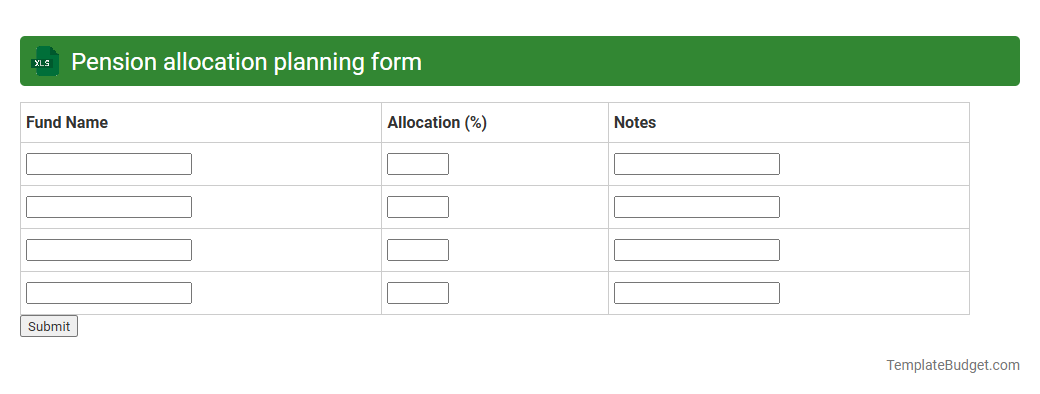

Pension allocation planning form

An Excel Pension Allocation Planning Form typically contains detailed worksheets for tracking individual pension contributions, projected retirement benefits, and allocation percentages across various pension funds. It includes data fields such as employee details, current pension balance, expected retirement age, and investment growth assumptions. The form often features charts and formulas to calculate future pension payouts and optimize allocation strategies for maximizing retirement income.

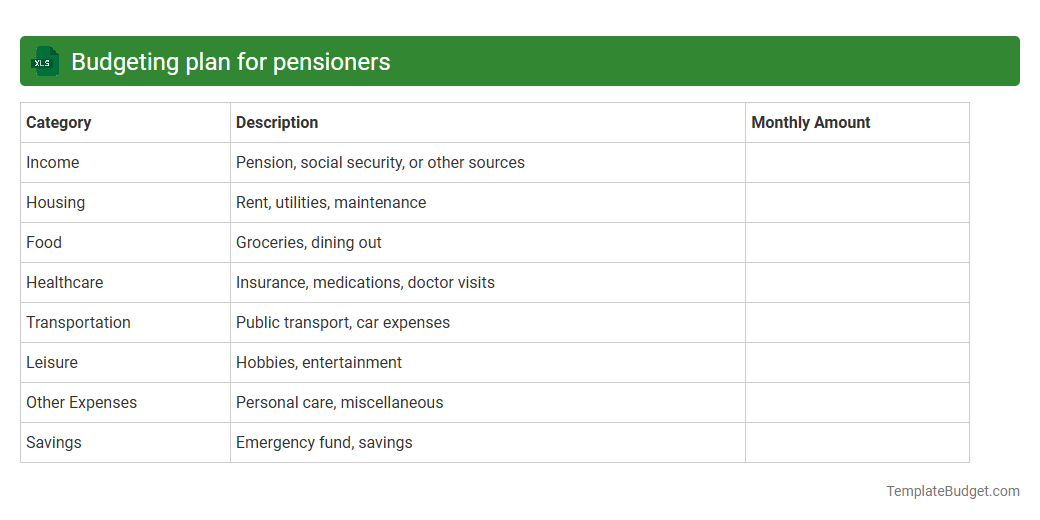

Budgeting plan for pensioners

An Excel document for a budgeting plan for pensioners typically contains detailed income sources such as pensions, Social Security, and investments, alongside categorized expenses like healthcare, housing, and daily living costs. It includes formulas to calculate monthly and annual cash flow, track spending patterns, and forecast future financial stability. Charts and summary tables are often embedded to provide clear visual insights into budget allocations and savings progress.

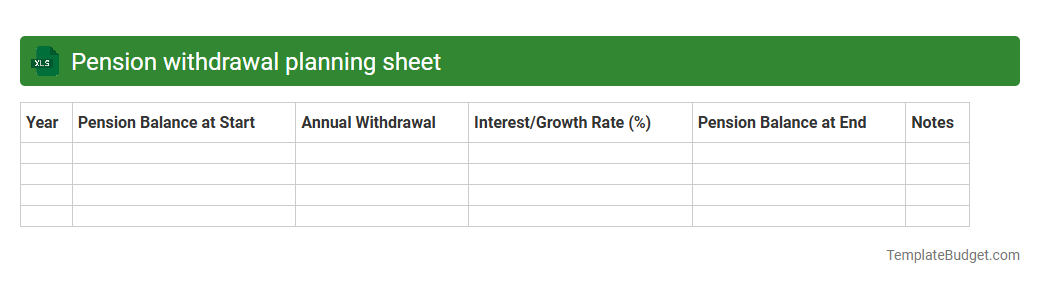

Pension withdrawal planning sheet

A Pension Withdrawal Planning Sheet in Excel typically contains detailed sections for tracking retirement fund balances, withdrawal schedules, and tax implications. It includes formulas to calculate monthly or annual withdrawal amounts based on factors such as life expectancy, inflation rates, and expected investment returns. Charts and graphs often visualize cash flow projections to help optimize financial decisions during retirement.

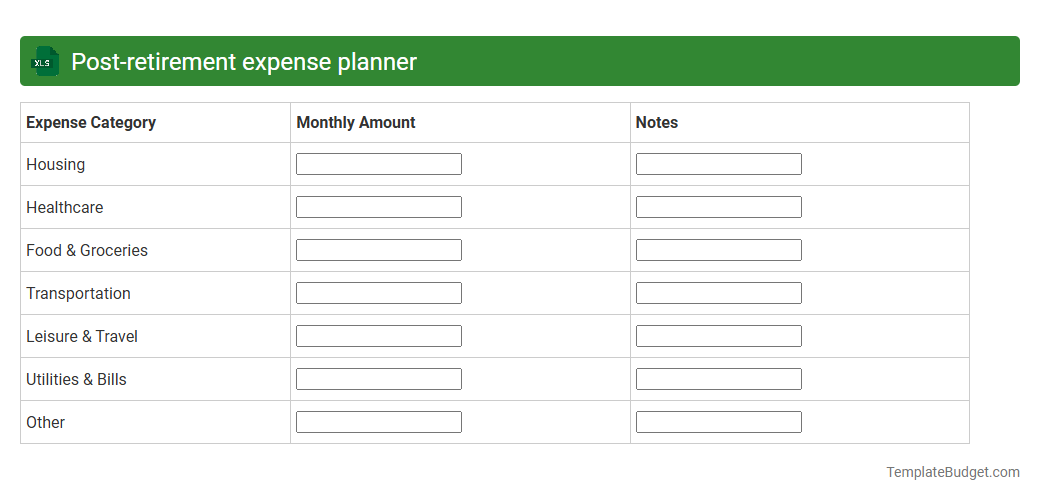

Post-retirement expense planner

An Excel post-retirement expense planner typically includes detailed categories such as housing, healthcare, transportation, food, leisure, and miscellaneous expenses, allowing users to itemize and project their monthly and annual costs. It often features customizable fields for inflation rates, expected Social Security income, pensions, and investment withdrawals to provide a comprehensive cash flow overview. Built-in formulas and charts help visualize budget gaps and surplus, enabling efficient long-term financial planning for retirement stability.

Understanding the Importance of a Pension Budget Planner

A pension budget planner is essential for managing your retirement finances effectively. It helps you estimate income, control expenses, and avoid financial shortages during retirement. Early planning ensures a comfortable and stress-free retirement life.

Key Features of Effective Pension Budget Planners

Effective pension budget planners include income forecasts, expense tracking, and investment projections. They provide alerts for potential shortfalls and allow for easy adjustment of assumptions. These tools are designed to be user-friendly and customizable to individual needs.

Steps to Create a Personalized Pension Budget

Start by listing all expected retirement income sources and estimate monthly expenses. Incorporate future inflation and healthcare costs to get a realistic budget. Regularly review and refine the budget to maintain financial stability.

Assessing Your Retirement Income Sources

Identify all income streams such as social security, pensions, and investments. Understanding the total income you can rely on is crucial for accurate budgeting. This helps in planning withdrawals and maintaining cash flow.

Calculating Future Expenses in Retirement

Future expenses include housing, healthcare, travel, and daily living costs. Consider inflation and unexpected costs when estimating these expenses. Accurate expense calculation prevents budget shortfalls and financial stress.

The Role of Investment in Pension Planning

Investments play a critical role in growing your retirement savings and combating inflation. Diversified portfolios reduce risk and enhance long-term returns. Proper investment strategies ensure sustainable income throughout retirement.

Tracking and Adjusting Your Pension Budget

Regular tracking allows you to monitor spending and income changes accurately. Adjust your pension budget based on market performance and life changes. This proactive approach keeps your retirement plan on track.

Common Mistakes to Avoid in Pension Budgeting

Avoid underestimating expenses and over-relying on uncertain income sources. Ignoring inflation and failing to update your plan regularly are common errors. Awareness of these mistakes improves pension budget reliability.

Useful Tools and Apps for Pension Budget Planning

There are many apps that simplify budgeting, track investments, and forecast income. Choose tools that offer real-time updates and easy integration with financial accounts. These apps enhance accuracy and convenience in pension planning.

Expert Tips for Successful Pension Management

Experts recommend starting early, diversifying investments, and regularly reviewing your budget. Prioritize emergency funds and consult financial advisors for personalized advice. Following these tips ensures effective and secure pension management.

More Retirement Excel Templates