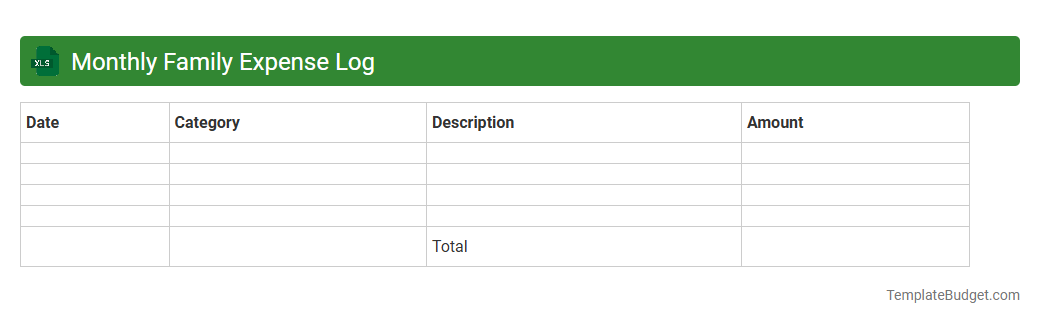

Monthly Family Expense Log

An Excel document titled "Monthly Family Expense Log" typically contains columns for date, expense category, description, payment method, and amount spent, enabling detailed tracking of household expenses. It often includes summary sections or pivot tables that categorize monthly totals by each expense type such as groceries, utilities, transportation, and entertainment. Charts or graphs may be embedded to visually represent spending trends and budget adherence over time.

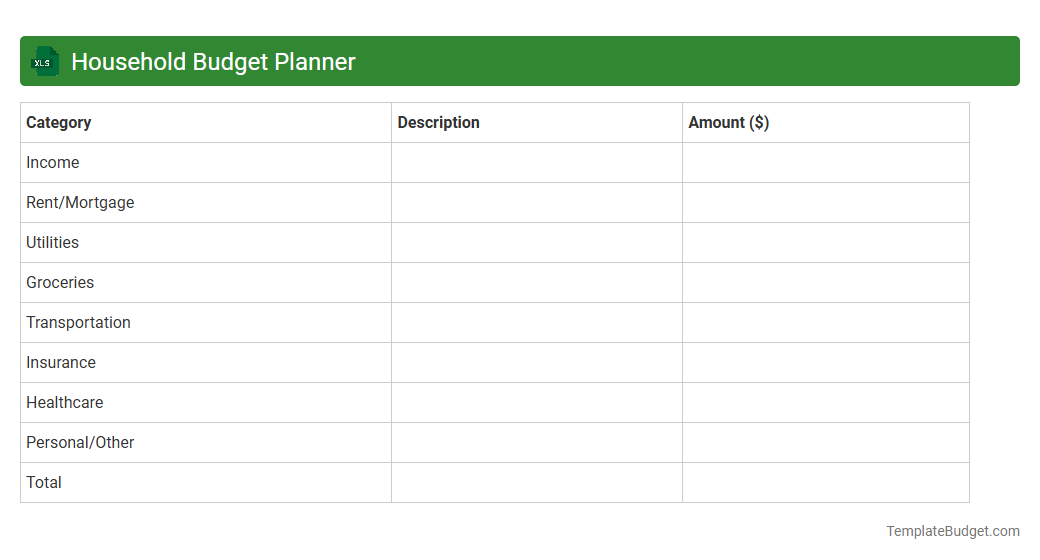

Household Budget Planner

An Excel Household Budget Planner typically contains income categories such as salary, bonuses, and other sources, alongside expense sections like housing, utilities, groceries, transportation, and entertainment. It features columns for tracking monthly budgets, actual spending, and variance analysis to monitor financial health. Charts and summary tables often visualize spending patterns and savings goals for effective household financial management.

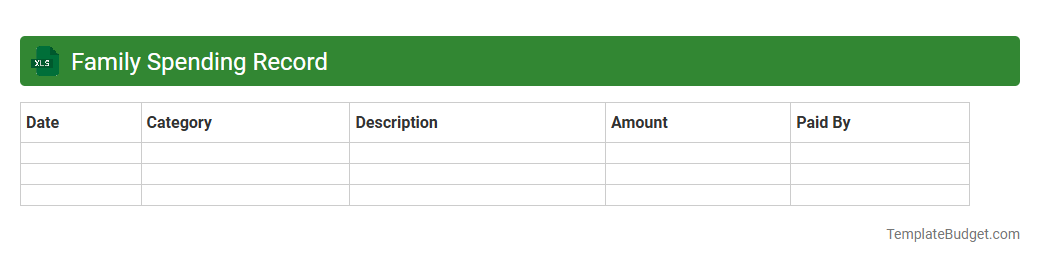

Family Spending Record

An Excel document titled "Family Spending Record" typically contains categorized expense entries such as groceries, utilities, rent, transportation, and entertainment, organized by date for monthly tracking. It often includes columns for budgeted amounts, actual spending, and variance to monitor financial discipline and identify savings opportunities. Charts and summary tables may be embedded to visually analyze spending patterns and support informed budget adjustments.

Home Finance Tracker

An Excel document titled Home Finance Tracker typically contains categorized sheets for income, expenses, savings, and budget planning. It includes tables with date-stamped entries detailing transactions, monthly summaries with pivot tables, and formulas to calculate totals, balances, and spending trends. Visual elements such as pie charts and bar graphs help analyze cash flow, debt reduction, and financial goals.

Parent Monthly Budget Sheet

An Excel document titled "Parent Monthly Budget Sheet" typically contains categorized income and expense fields such as salaries, utilities, groceries, transportation, and childcare costs. It includes formulas to calculate totals, track monthly spending against budgeted amounts, and visualize financial data through charts or graphs. Users often find sections for savings goals, debt payments, and notes for financial planning adjustments.

Family Cost Organizer

An Excel document titled Family Cost Organizer typically contains categorized expense tables, budget tracking sheets, and monthly income summaries to help manage household finances. It often includes formulas for automatic total calculations, charts for visual expense analysis, and sections dedicated to recurring bills, groceries, utilities, and savings goals. This structured layout enables efficient monitoring of spending patterns and supports effective financial planning for families.

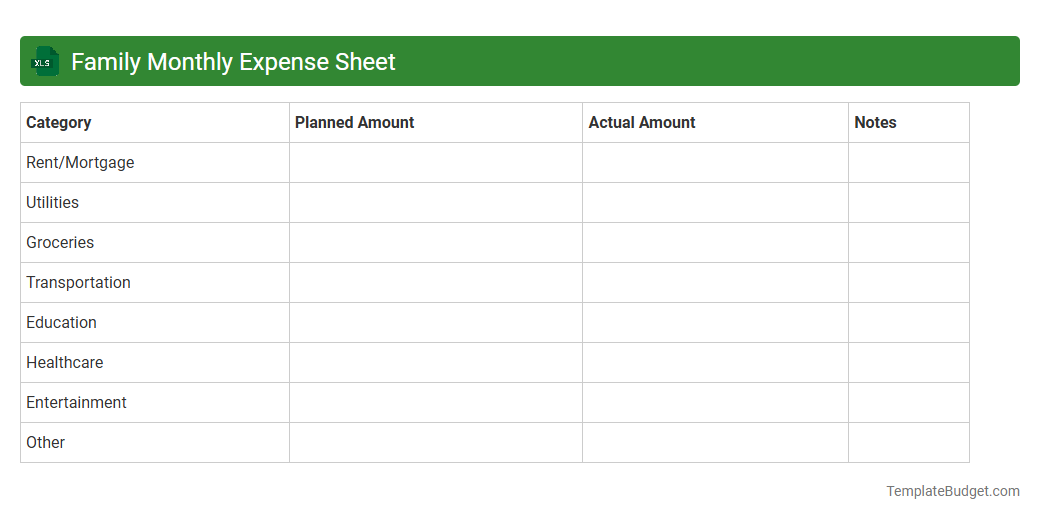

Family Monthly Expense Sheet

An Excel Family Monthly Expense Sheet typically includes categorized expense entries such as groceries, utilities, rent or mortgage, transportation, and entertainment. It contains columns for dates, descriptions, budgeted amounts, actual expenses, and variance calculations to track spending habits effectively. Formulas and charts are often embedded to summarize total expenses, compare budgets versus actual spending, and visualize financial trends over the month.

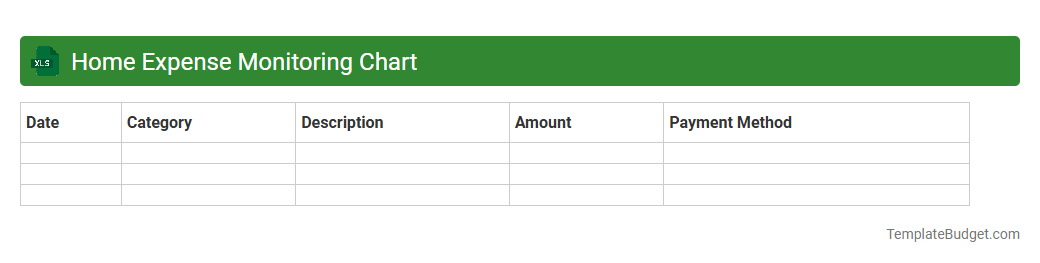

Home Expense Monitoring Chart

An Excel document titled "Home Expense Monitoring Chart" typically contains categorized expense data such as utilities, groceries, rent, and entertainment organized in rows and columns. It often includes formulas for calculating total expenses, monthly budgets, and variance analysis to track spending habits accurately. Visual elements like bar graphs or pie charts may be embedded to provide clear, graphical representation of financial trends over time.

Family Budget Management Template

An Excel Family Budget Management Template typically includes categorized sections for income sources, fixed and variable expenses, savings goals, and debt tracking, enabling comprehensive financial oversight. It features built-in formulas to automatically calculate totals, balances, and remaining budgets, ensuring accurate and real-time updates. Visual elements such as charts and graphs are often integrated to help users analyze spending patterns and identify opportunities for cost reduction.

Monthly Household Spending Tracker

An Excel document titled "Monthly Household Spending Tracker" typically contains categorized expense fields such as groceries, utilities, rent or mortgage, transportation, and entertainment, organized by date or week. It includes columns for budgeted amounts, actual spending, and variance to help users monitor their financial habits and identify overspending. Charts and summary tables often visualize monthly trends and total expenditures, enhancing financial planning and decision-making.

Understanding the Importance of a Monthly Family Expense Tracker

A monthly family expense tracker helps households gain clear insight into their spending habits, enabling better financial decisions. It highlights where money goes, preventing overspending and promoting savings. Regular tracking fosters financial responsibility among all family members.

Key Features of an Effective Expense Tracking System

An effective system includes ease of use, real-time updates, and customizable categories. It should provide clear summaries and alerts for budgeting limits. Integration with bank accounts and bills enhances accuracy and convenience.

Setting Up Your Family Budget Categories

Organize expenses into meaningful categories such as housing, groceries, utilities, and entertainment. This helps identify spending patterns and areas to cut costs. Ensure categories reflect your family's unique needs and priorities for better tracking.

Choosing the Right Expense Tracking Tools and Apps

Select tools or apps based on features, compatibility, and user-friendliness. Popular options offer syncing with bank accounts and multiple user access. Opt for solutions that support your family's budgeting style and tech preferences.

How to Record and Organize Family Expenses

Consistently record each expense immediately after purchase to avoid missing details. Use a centralized app or spreadsheet accessible to all family members. Categorizing expenses promptly ensures organized financial data.

Tips for Involving Every Family Member

Encourage open discussions about money and assign expense tracking roles to each family member. Teaching kids about budgeting fosters financial literacy early. Collaborative tracking builds accountability and shared goals.

Analyzing Monthly Spending Patterns

Regularly review your tracked data to spot trends in income and expenses. Identify high-spending categories and opportunities for saving. Use this analysis to adjust your budget and enhance financial health.

Strategies to Reduce Unnecessary Expenses

Focus on cutting non-essential purchases and finding cheaper alternatives. Create a list of impulse spending triggers and plan ahead to avoid them. Implementing cost-saving habits strengthens overall budget control.

Setting Financial Goals and Staying on Track

Define clear, achievable financial goals like savings targets or debt reduction. Use your expense tracker to monitor progress and adjust as needed. Celebrating milestones helps maintain motivation towards financial stability.

Reviewing and Adjusting Your Expense Tracker Regularly

Periodic reviews ensure your tracking system stays aligned with changing family needs. Update categories, budgets, and tools as your financial situation evolves. Continuous improvement leads to more effective and accurate budgeting.